The rhythm of October felt steady but uncertain. Equity markets climbed higher, brushing against record levels, yet the higher they rose, the quieter the applause seemed to get. It’s the paradox of success: when you reach the peak, the air is thinner, and the silence, louder.

That feeling isn’t unfamiliar in finance. Markets, too, can suffer from altitude sickness. When indices reach historic highs, investors start to question what still supports them. Are we standing on solid ground, or on clouds of optimism?

Let’s find out together. Enjoy the read.

Table of Contents

- The market at a glance: It's lonely at the top

- Key takeaways

- What happened with equities

- What happened with bonds

- What happened with commodities, currencies, and digital assets

- Demystification room: Shadow Banking, The (not so) hidden side of Finance

- Access Switzerland’s best credit conditions through our partner Milenia

The market at a glance: It's lonely at the top

Song of the month: “It's lonely at the top" by Randy Newman

In 1971, at Capitol Records’ studios, Randy Newman, an Oscar-winning American songwriter, as brilliant as he is biting, offered a song to another legend, Frank Sinatra. It’s Lonely at the Top is a ragtime ballad, a melancholic satire on ultimate success. It tells the story of a man who has seen it all, conquered it all, and finds nothing left to satisfy him. Sinatra seemed the perfect voice for such a confession. But the star balked, hard to sing out loud what life at the summit often forces you to keep quiet.

Newman ended up recording it himself on an album released the following year. And it’s from him that I borrow this song to open today’s column. Because what investor hasn’t felt that strange solitude at the top? When markets brush against record highs, the air thins, and you oscillate between the fear of selling too soon and the dread of watching your wealth swallowed by the next crash. A loneliness, too, often unspoken.

In finance, peaks are unsettling because you never really know what holds them up, or whether an even higher one lurks just beyond.

Right now, with half the assets in our portfolios hovering near historic highs and cracks appearing here and there, we’d love to know what lies around the next bend: a base camp… or an avalanche.

Key takeaways

When markets hover near their peaks, vertigo sets in and investors, like Sinatra, fear admitting their solitude.

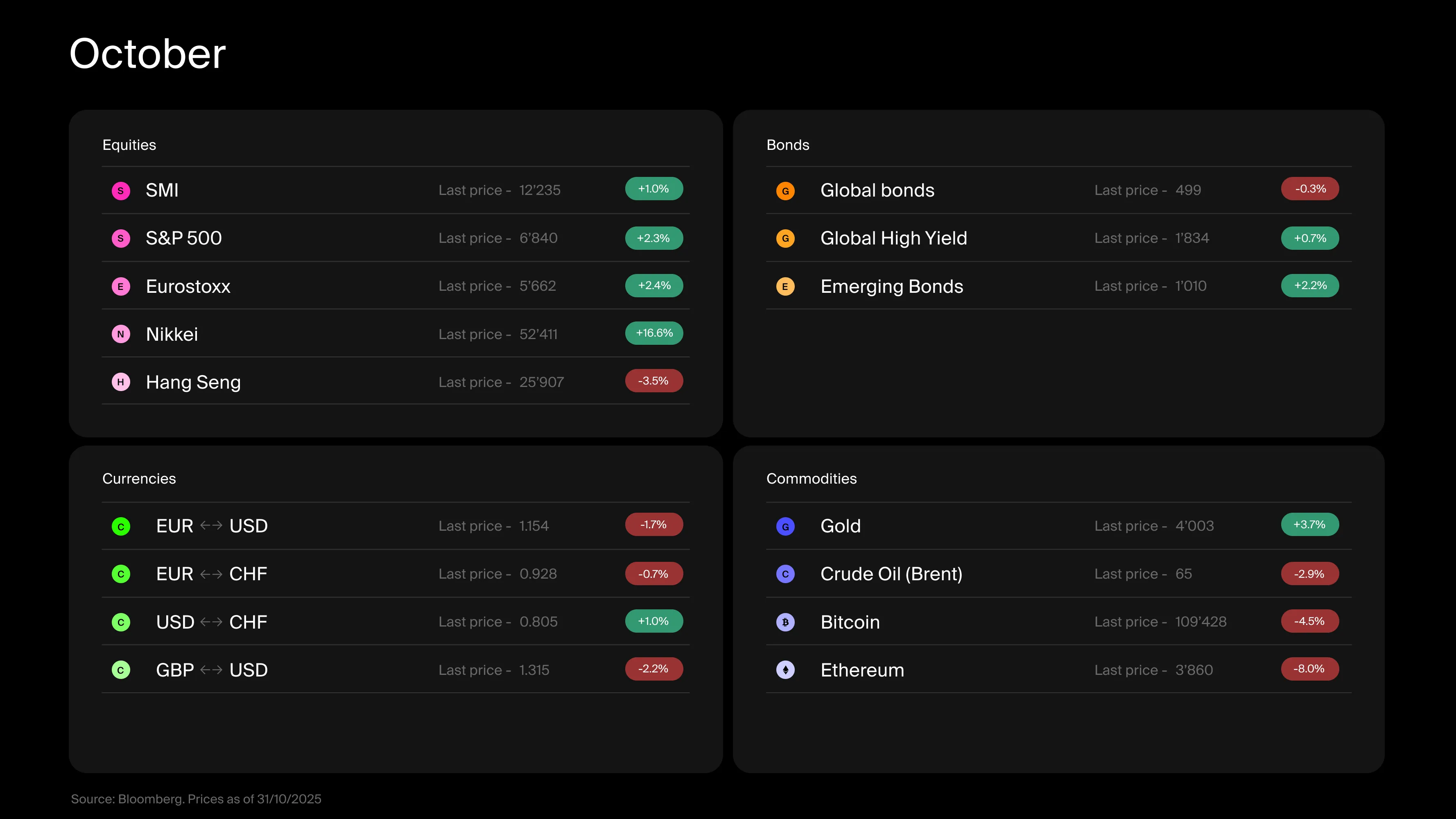

Despite some turbulence, most equity indices continued their climb in October, raising the question: is this growth sustainable?

Bond markets tell a different story and may offer shelter if the storm arrives.

After reaching all-time highs, Gold and Bitcoin are catching their breath.

American Express Platinum Card at only CHF 450 instead of CHF 900

What happened with equities

To gauge a market’s altitude, or, in financial terms, its expensiveness, you can take several views.

The first is to look back and measure the climb. Compare today’s price to past levels and you get a sense of how far we’ve come. Let’s look at major equity markets: U.S. equities (S&P 500), European equities (Euro Stoxx), Swiss equities (SMI), and emerging markets. Over the past decade, their total returns in local currency have been striking: +290% (14.7% per year), +124% (8.48% per year), +87% (6.52% per year), and +127% (8.65% per year), respectively. These are impressive ascents, especially for the U.S. market, whose long-term average growth since 1950 hovers around 11.5%.

But before we get dizzy, remember this view is limited. It’s relative, it only shows how much we’ve climbed over a given period. Today’s prices reflect a fundamentally different context. The real question is whether this price evolution aligns with the evolution of that context over the same span.

The second perspective is to check the instruments, to estimate an asset’s intrinsic value based on expected future gains, adjusted for time and risk. Every financial analyst is trained to value companies using the cash flows and dividends they generate. From this angle, most valuation metrics for U.S. equities point to a degree of expensiveness. That doesn’t imply an imminent correction, but it does suggest these assets aren’t cheap, or that they already embed a strong growth assumption that must eventually materialize. By contrast, valuations for Swiss, European, and emerging markets appear more reasonable, which could make a compelling case for diversification.

Finally, you can stop staring at the trail behind or the theoretical map and look around. At this moment, in this economy, how does this asset compare to others? In an environment of sluggish growth, geopolitical fog, and a lingering fear of monetary debasement, the relative expensiveness of U.S. stocks makes more sense: investors pay a premium for the promise of growth. They even tolerate blind spots, like complex revenue loops in tech, as long as the top line keeps trending upward.

What happened with bonds

If we apply the same lens to bond markets, the picture looks quite different. Historical returns over the past decade have been far less impressive. When central banks hiked rates in 2022 to curb inflation, bond prices suffered. Today, yields are appealing, particularly in the U.S., where lending to the government for one year earns around 3.67%. If the Fed continues to cut rates, there could even be room for capital appreciation. In Europe, yields are decent too, though less generous. Switzerland is the exception: the Swiss National Bank, seemingly struck by altitude sickness, has cut rates back to 0%. Overall, Switzerland aside, bonds now stand out as a credible contender among asset classes, making them an attractive option for diversification.

What happened with commodities, currencies, and digital assets

Now for the interesting part: extremes in commodities, currencies, and digital assets. Gold and Bitcoin have recently hit all-time highs, while the Swiss franc has hardly stopped appreciating. Yet valuing these asset classes is far more challenging, they produce no cash flows or dividends, leaving us without a clear way to assess their intrinsic value. In other words, determining what they should theoretically be worth becomes a highly subjective exercise.

In the end, whichever lens you choose, many markets appear closer to the summit than the valley. The real question is whether the foundations are solid. Economies, like mountains, tend to be resilient, but altitude can distort perception. As noted in a previous column, small corrections can turn into crises when key pillars give way: deep and prolonged slowdown, excessive debt, shrinking liquidity, or banking stress.

Today, the slowdown is visible, but the engine still runs. Liquidity is tightening, though the Fed could intervene. Debt? Hard to deny it has surged. Banks, strengthened since 2008, remain broadly robust, though part of the financing has shifted to the “shadow banking” sector (see our Demystification room section), where tremors are already felt. In short, we’re not standing on a house of cards, but the structure isn’t flawless.

For now, the view from the top isn’t bad: as I write, the S&P 500 flirts with 7,000 points. But storm warnings are flashing amber.

Each of us must face the solitude of high altitudes. Some prepare their shovel and avalanche beacon, others adjust their gear and keep climbing. In finance, as in the mountains, there is no true summit, only temporary ledges from which we pause to contemplate the world beyond. The good news? Other asset classes may offer shelter.

Demystification room: Shadow Banking, The (not so) hidden side of Finance

“Shadow banking.” It sounds like something out of a thriller, secret deals in dark alleys, coded messages, maybe a trench coat or two. In reality, it’s far less dramatic… and far more important.

When we think of banking, we picture traditional banks, places that take deposits, make loans, and are tightly regulated. But there’s another world operating alongside them: shadow banking.

Shadow banking refers to financial activities carried out by institutions that aren’t traditional banks but still provide credit and liquidity. These include investment funds, pension funds, insurers, hedge funds, private equity firms, money market funds, and peer-to-peer lenders. They don’t take deposits like banks do, and they operate outside the strict regulations that govern banks. This flexibility allows them to move fast, but it also means less transparency and oversight.

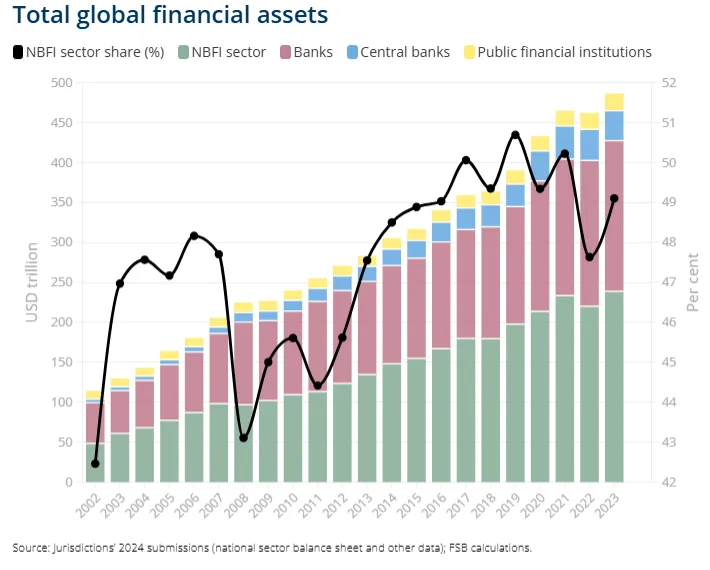

And here’s the twist: it’s not really “hidden.” Shadow banking is everywhere in modern finance. The size of this system is hard to pin down, and estimates vary widely. The most comprehensive research puts it at around $70 trillion, roughly half of all global financial assets. So while you won’t see a “Shadow Bank” sign on your street, chances are your pension fund or your insurance company are part of this world.

Why does this matter? Shadow banking plays a critical role in financing businesses and markets, but it can also amplify risks during financial stress. When things go wrong, the lack of regulation can turn small shocks into big crises, as we saw in 2008.

In short, shadow banking is the parallel financial system, essential for credit flow, but with hidden vulnerabilities that regulators keep a close eye on.

Access Switzerland’s best credit conditions through our partner Milenia

When markets climb this high, it’s easy to feel the distance between lofty valuations and everyday realities. But true financial confidence isn’t built on dizzying heights, it’s grounded in balance, clarity, and the freedom to move forward when the moment feels right.

That’s why, beyond investing, Alpian also helps clients take control of their broader financial journey, including access to smarter financing options through our trusted partner, Milenia.

Whether you’re planning a home renovation, funding studies, or simply want to make a project happen without disturbing your investments, Milenia helps you stay grounded.

By applying through Alpian, you benefit from preferred advantages:

Priority processing of your credit request

Rates starting from 4.9% (up to 10.95%)

Flexible durations from 6 to 120 months

Loan amounts from CHF 3’000 to CHF 400’000

Application in less than 3 minutes, fully online

)

)

)

)

)

)

)

)