This month, markets moved with a mix of hesitation and quiet determination. Nothing dramatic, nothing euphoric, just that familiar in-between rhythm investors know all too well.

When the economic signals blur and the bigger picture refuses to settle, we often look for something steady to hold on to, companies, their earnings, and the people who keep them running. And as volatility persists, this return to fundamentals feels less like caution and more like instinct.

So before getting into the details, let’s pause and look at the month as a whole. Because resilience isn’t just something we observe in markets or in the corporate world, it’s something we see in the way households organise their financial lives, and in the decisions individuals make to strengthen their own futures like retirement planning.

Enjoy the read.

Table of Contents

The market at a glance: Takin’ Care of Business

Song of the month: “Takin’ Care of Business" by Bachman-Turner Overdrive

Rock history is full of colorful anecdotes, and among the most fascinating are those moments when a song is born live, right before the audience’s eyes. Few stories illustrate this better than Takin’ Care of Business, by Bachman-Turner Overdrive, released in 1973.

During a club gig, the Canadian band ran out of songs. Randy Bachman, the lead singer and guitarist, inspired that night, asked the musicians to play a simple three-chord riff. He then improvised lyrics for a tune he had long kept in his back pocket, one the band had previously rejected.

The result was electric, the crowd went wild and begged for more. After a few tweaks, the song was recorded in the studio. Its success came not just from its catchy rhythm but from its lyrics, which celebrate everyday workers, getting up early, commuting, working hard to “take care of business.” I’m borrowing that spirit for this column because, just as the song suggests, businesses are the true heartbeat of the economy.

When markets sway, macro indicators send mixed or missing signals, and policymakers offer little clarity, investors always return to the basics, companies' earnings. The Q3 2025 reporting season was the perfect moment to take the pulse.

So, did workers truly ‘take care of business’? And more importantly, what lessons can we draw from these results to position portfolios for what’s ahead?

Key takeaways

When markets sway and macro indicators offer little clarity, investors return to the basics, corporate earnings.

In Q3, workers truly “took care of business,” as companies reported strong results.

Equity markets weren’t cheering, though as risks remain on the radar.

Bonds posted gains, while commodities and digital assets turned as red as autumn leaves.

Despite these risks, there are buffers and corporate resilience is one of the strongest.

What happened with equities

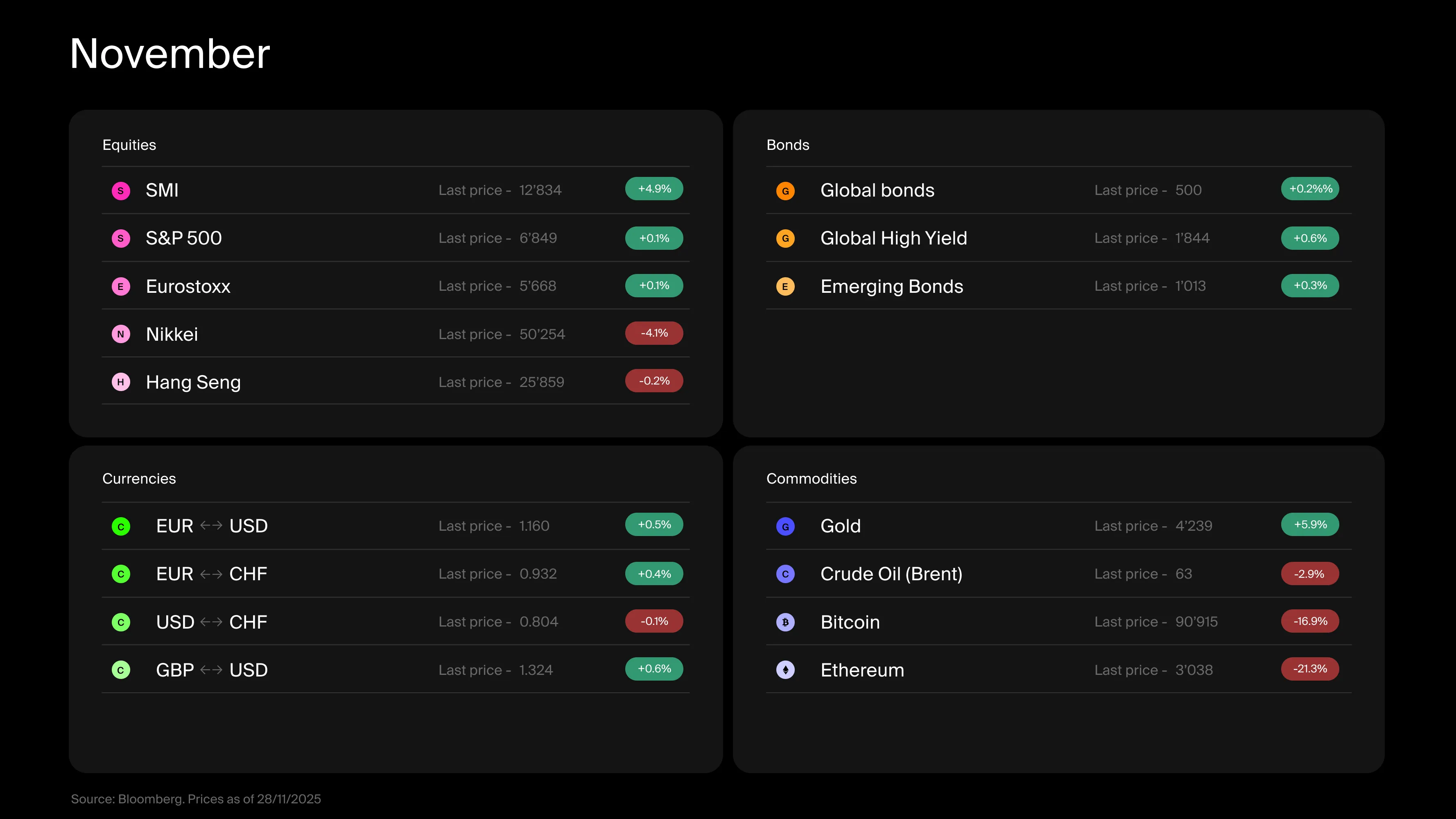

Let’s start with a quick look at the markets. November wasn’t exactly a party for equities. Most major indices, from the U.S. to Europe and China, ended the month flat. The one bright spot? Switzerland, where stocks jumped 4.90 %, helped by relief that tariff penalties would be lighter than feared.

We did get a few interesting economic data points, but the real spotlight was on corporate earnings for Q3 (every quarter, companies disclose their financial results, including how much profit they made and how much revenue they generated). And to answer our opening question, yes, businesses, and their workers, really did take care of business.

In the U.S., the numbers speak for themselves, over 80 % of S&P 500 companies beat profit forecasts (meaning they earned more than analysts expected), and nearly three-quarters exceeded revenue estimates. Overall, profits grew 13.40 % compared to last year, marking a fourth straight quarter of strong growth. Across the Atlantic, Europe also delivered, with profits up 6.10 %, a clear improvement over previous quarters.

So why aren’t markets cheering?

Investors remain cautious, worried about a few big risks, heavy reliance on artificial intelligence (AI) and a handful of tech giants for growth, the potential impact of tariffs, and lingering uncertainty in the job market.

Still, there’s reason for optimism. Yes, the “Magnificent 7” (a nickname for seven U.S. tech giants that drive the economy, Apple, Microsoft, Alphabet/Google, Amazon, Meta/Facebook, Tesla, and Nvidia) along with AI, continue to drive growth. But this quarter brought a pleasant surprise, other sectors stepped up. Healthcare, financial services, and consumer goods were among the biggest contributors. In short, workers aren’t just keeping the wheels turning, they’re spending too.

Here’s another twist, if you exclude those seven tech giants, the remaining 493 companies in the S&P 500 grew profits by 11.90 %, beating the Magnificent 7’s 5.60 %, their weakest since 2023. The AI hype may be cooling, but sectors once thought stagnant are proving resilient.

And tariffs? So far, no real impact which is a welcome sign. But like interest rates, these effects usually take time to show.

This isn’t to paint an overly rosy picture, risks remain. First, these strong results were widely anticipated and are already reflected in stock prices. A strong earnings season sets a high bar for the next, leaving little room for positive surprises, and the U.S. market is already expensive. Second, reliable data on the health of the labor market is scarce. But at least the heart of the economy, its corporate sector, doesn’t look in bad shape.

What happened with bonds

Businesses that keep going, paradoxically, create another challenge, their resilience puts the Federal Reserve in a tricky position ahead of its December meeting. If companies remain strong, consumer spending holds up, and inflation risks flare again, is now really the time to cut interest rates?

Normally, central banks lower rates, or adopt a more accommodative monetary policy, when the economy needs a boost. What worries investors, however, is that unemployment is starting to rise. If more workers are sidelined, who will “take care of business”? Yet there’s also a risk in pumping more hot air into an economy that’s already running warm.

We’ll find out in December which way the Fed leans. Logically, and if we listen to Chairman Jerome Powell, we shouldn’t get our hopes too high. But investors think otherwise, they expect a rate cut this month and even more next year. And they have a powerful ally, a U.S. president who believes rates should be much lower.

In Switzerland, this debate doesn’t exist. The Swiss National Bank has already decided, against all conventional wisdom, that interest rates should be at zero. In fact, it’s now under pressure from insurers and banks to raise them.

Either way, the possibility of lower rates at some point is good news for bonds. And November wasn’t bad for global fixed-income markets, which ended the month on a positive note.

What happened with commodities, currencies, and digital assets

On the commodities and digital assets front, November was brutal. With one exception, gold, which gained another 5.90 %, market performance turned the color of autumn leaves, deep red, and headed downward. On crypto markets, we witnessed a level of volatility and mass liquidations not seen in a long time.

The reason? That’s the tricky part. Look at any research report from major digital players and they now read like equity research, citing the same factors we discussed earlier, economic uncertainty, central bank policy, and investor sentiment. But if those were the real drivers, we would have seen similar moves in other markets, and we didn’t.

Over the past five years, Bitcoin has shown a relatively strong correlation with tech stocks. The fact that analysts now lean on this rationale suggests two things, the asset class is becoming mainstream, and we still don’t fully understand what moves it. And that’s okay, as long as we remember that volatility is part of the DNA of this market.

And that brings us back to the bigger picture. Volatility isn’t just a crypto story, it’s a reminder that risk is part of investing, and our job is to understand and manage it. Yes, there are risks on the radar, but there are also buffers. Healthy companies make an economic collapse far less likely. And in the not-so-unlikely event of a market correction, investors can count on two safety nets, the “Fed put” (the idea that the Federal Reserve would step in to support markets) and corporate strength itself, which can act as a natural floor, as we saw back in 2022.

So, let’s suit up, squeeze into the commute, and take care of business!

Demystification room: What does household wealth in Switzerland look like?

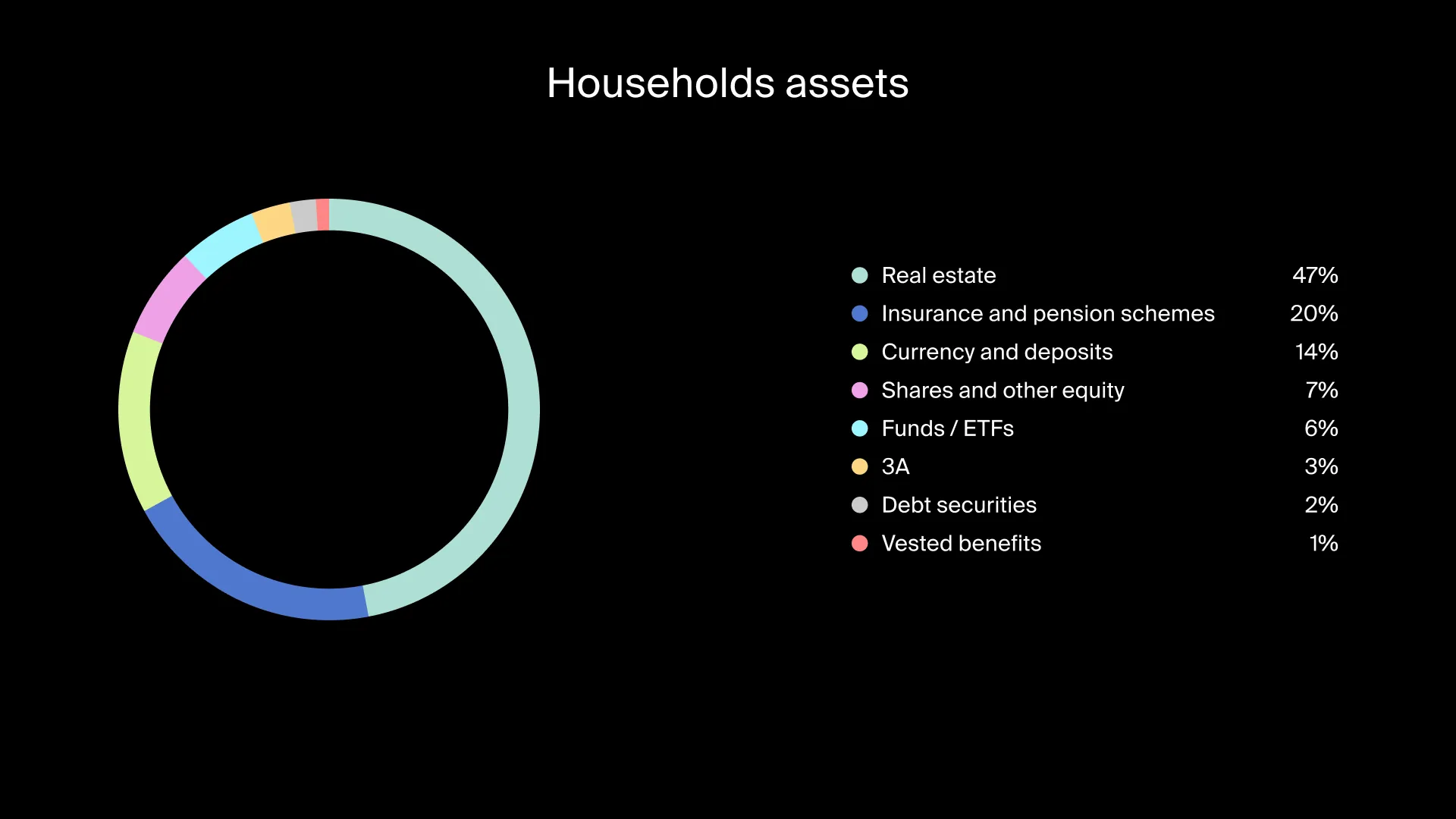

Imagine pooling together all Swiss households and taking a snapshot of their combined wealth..what would it reveal? The chart below, based on data from the Swiss National Bank, offers a clear picture.

Unsurprisingly, real estate dominates household wealth and the debt that comes with it. In second place is the second pillar, those monthly contributions deducted from our salaries, invested in financial markets to secure our retirement (or at least that of today’s retirees).

Next comes cash holdings, money sitting in current accounts remains the preferred choice for many Swiss people. Then we have investments, which have grown significantly in recent years, especially through ETFs. And finally, perhaps too far down the list, the third pillar, despite its many advantages and its essential purpose, filling the gaps in our retirement planning.

Your future deserves more than a small slice

If there’s one lesson from this month’s market picture, it’s that resilience doesn’t happen by accident. Households, just like companies, “take care of business” by building buffers, diversifying, and preparing for what comes next.

That’s what makes the chart above so striking. While real estate and pension assets make up the bulk of Swiss household wealth, the third pillar represents only a small slice, despite its tax advantages and its role in strengthening long-term financial security. In other words, an instrument designed to protect workers’ future is still underused by many.

At Alpian, we believe the Pillar 3a should be a natural part of the financial toolkit, especially in uncertain times, when relying solely on markets or on the first two pillars can feel like navigating with only half a compass.

With the Alpian Pillar 3a you can:

Pay 0 % management fees for all of 2025 and 2026.*

Deduct up to 7'258 CHF from your taxable income

Invest exclusively in BlackRock funds, choosing between:

Swiss strategy, focused on companies shaping Switzerland’s economy.

Global strategy, diversified across leading international markets.

Maintain complete flexibility, access your savings early if you buy a home, become self-employed, or move abroad.

Just as companies kept the economy running this quarter, your Pillar 3a helps your long-term finances keep running, quietly, consistently, in the background. A small slice on the chart, but a meaningful one for your future.

*Offer reserved for the first 1'000 Pillar 3a accounts opened. For 2025 and 2026, all management and foundation fees are fully reimbursed. Only minimal underlying fund costs (around 0.15% TER) and applicable VAT remain. Alpian reserves the right to modify or discontinue this offer at any time without prior notice.

iShares® and BlackRock® are registered trademarks of BlackRock Finance, Inc. and its affiliates ("BlackRock") and are used under license. BlackRock makes no representations or warranties regarding the advisability of investing in any product or the use of any service offered by Alpian SA.

This communication is for informational purposes only and does not constitute investment, legal, or tax advice. The Pillar 3a solution presented is a tax-qualified retirement savings product subject to Swiss regulatory conditions. Contributions to Pillar 3a accounts may be tax-deductible, and withdrawals are permitted only under specific circumstances defined by law (e.g., retirement, home ownership, or self-employment).

Investment strategies within Pillar 3a may involve exposure to financial markets and are subject to market risks, including potential fluctuations in value. Before making any investment decision, we recommend consulting with a qualified financial advisor to assess your individual situation and objectives.

)

)

)

)

)

)

)