First of all, we would like to wish you a Happy New Year! We hope 2026 brings you joy and prosperity and that markets deliver opportunities as abundant as those we saw in 2025.

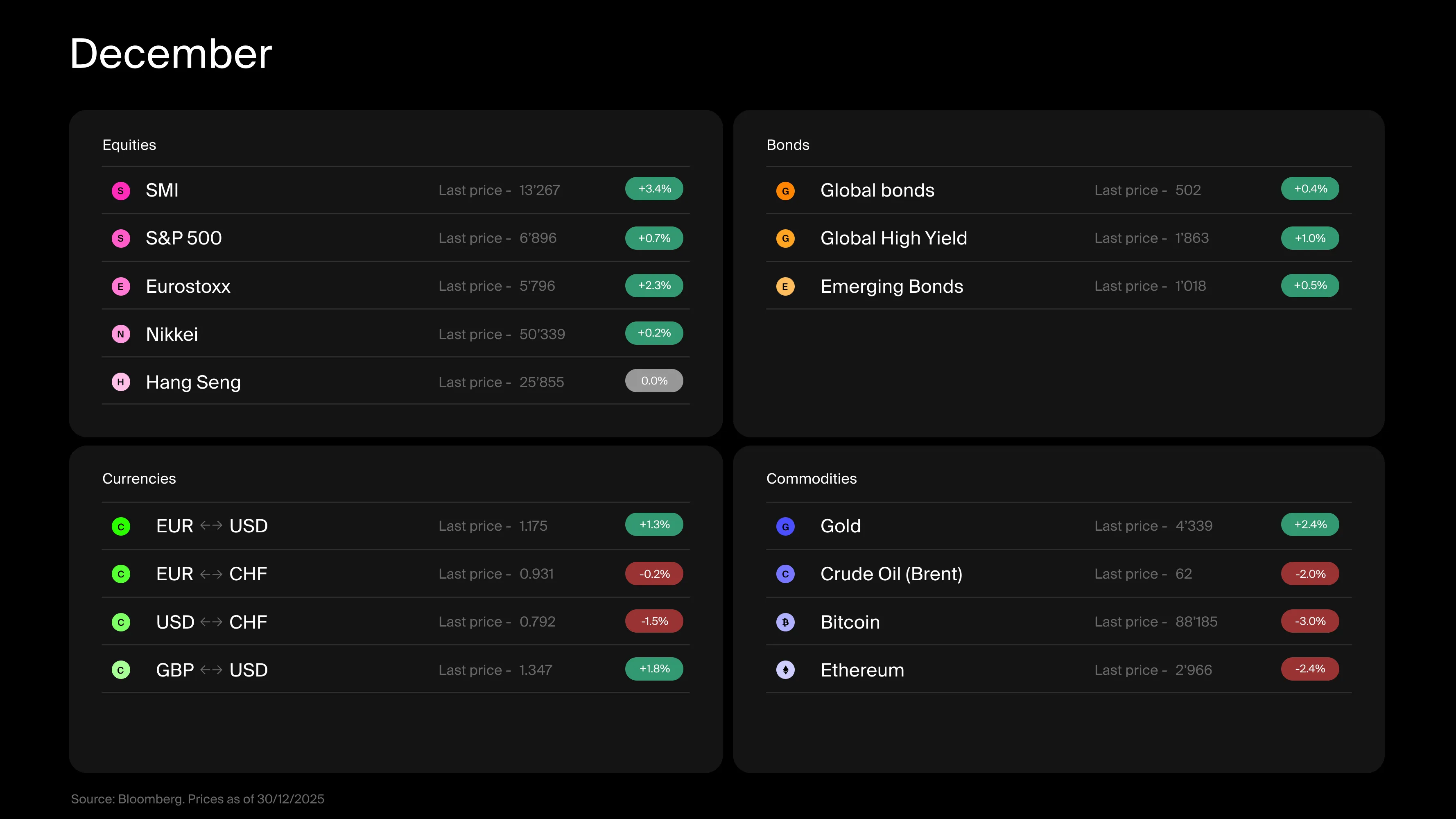

The past year was not without challenges, but overall, it proved rewarding for investors. 2025 will be remembered as a strong year for financial markets, once again surpassing many commentators’ expectations. At Alpian, we captured a good portion of the gains markets had to offer: for a balanced strategy, the average return was 8.29%, compared to 6.41% for the average asset manager in Switzerland (see our Demystification Room for more details on our performance).

Will 2026 be another great vintage? Time will tell, but we are ready to navigate whatever challenges lie ahead and help you stay focused on your long-term objectives.

Table of Contents

The market at a glance: Relax don't do it

Song of the month: “Relax" by Frankie goes to hollywood

Choosing “Relax, Don’t Do It,” the iconic 1983 hit by English new wave band Frankie Goes to Hollywood, as the soundtrack for this investment newsletter might seem like a risky choice. But you know what was even riskier? Acting on market emotions in 2025!

This past year felt like an emotional roller coaster for many investors, driven by catchy headlines and sudden market swings. The temptation to exit in April was strong. The urge to lock in gains in September was just as great. Yet, the best course of action was to stay invested. For those who remained patient, 2025 turned out to be rewarding.

So, “Relax, Don’t Do It”, don’t press the sell button, might have been the best piece of financial advice anyone could have received last year. I hope you’ll forgive this musical detour but it seemed fitting.

Before we share some thoughts on 2026, let’s take a quick look back at the main events and stories that shaped 2025.

Key takeaways

2025 felt like an emotional roller coaster for many investors, but the best advice was simple: “Relax, don’t do it” especially when the urge to sell was strong.

Equity markets delivered a strong year overall, both in absolute terms and by historical standards.

Fixed income, on the other hand, was far from a great vintage for bond investors.

Other markets were a mixed bag: gold shone brightly, while Bitcoin, quite surprisingly, did not.

And here’s a number worth remembering: 8%. That’s what a balanced investor would have missed by sitting on the sidelines this year. Will 2026 bring the same return?

What happened with equities

You can always count on equity markets for action. Traded by millions of investors (many of them algorithms, let’s not forget this) they react instantly to news, trends, and stories. And 2025 was no exception.

Most major indices worldwide ended the year higher than where they started. To put numbers on it: global stocks, as measured by the MSCI World Index, rose 21% in dollar terms. That’s a good vintage by historical standards, since 1970, the average annual return has been about 11%, and gains above 20% occur only about one-third of the time.

Of course, that headline only tells part of the story. First, because it’s not exactly the return investors get, even those who invest in securities that faithfully track index performance. Why? Even if you set aside fees, Swiss investors face one big headwind: currency strength. When we invest abroad, our returns are often eroded by the appreciation of the Swiss franc, and in 2025, the franc strengthened significantly against most currencies. In CHF terms, global stocks delivered just 6.2%. Still respectable, but it doesn’t have quite the same allure as 21%.

You can hedge against currency fluctuations, of course, and we did this year, but hedging comes at a cost. For example, an ETF tracking the MSCI World while hedging currency risk returned about 14% in 2025. Better than 6%, but not free.

Second, because a global index, heavily weighted toward certain regions, tells us little about which markets actually drove those gains or what happened elsewhere. And this is where it gets interesting. Digging deeper, we see sharp differences in performance across markets.

The U.S. market, usually the star of the show, rose 18% (but only 3.3% in CHF terms). Surprisingly, that wasn’t enough to top the charts, it ranked 64th out of 92 markets. Our own Swiss market matched the U.S. with an 18% gain, while Europe and Japan delivered 21% and 28% respectively in CHF terms. Even more striking, many emerging markets posted strong returns.

If this isn’t a sign that U.S. dominance is fading, it’s at least a powerful reminder of something we’ve long advocated: international diversification can pay off. Think about the energy spent this year dissecting headlines, debating tariffs, and analyzing moves from the Trump administration (including the 39% tariff briefly aimed at Switzerland) not to mention the endless chatter about AI driving gains. And think about the temptation to sell everything in April when markets were sinking, or in September when the US government shut down and recession fears resurfaced.

The truth? If you had taken a sabbatical and returned today to glance at global index performance, the story they tell would look very different from the one in the headlines.

Of course, the idea isn’t to sit idle or fall into complacency. After three years of strong returns, expecting another 20% in 2026 would be optimistic. But “Relax, Don’t Do It” might be a good reminder that sometimes putting a little distance between ourselves and the constant market chatter is the smartest move.

What happened with bonds

I have yet to meet a retail investor who gets excited about bond markets. Not because they lack drama, far from it, or because they’re niche (in fact, bond markets are larger than equity markets). But let’s face it: they don’t offer the adrenaline of cryptocurrencies, the thrill of stocks, or the tangibility of real estate. Nor did they offer much in the way of returns in 2025.

Those who ventured into riskier segments of the bond market saw slightly better results, but not enough to justify the extra risk. The only bright spot? Emerging market bonds, which delivered decent returns in CHF terms, reminding us once again that broadening the investment horizon can have merits.

Many factors explain the lackluster performance of bond markets, from the level of rates to persistent inflation to subdued demand. In Switzerland, with rates now back at 0%, the pressure on investors to take more risk is intensifying.

But should we completely ignore bonds in a portfolio? I wouldn’t. 2026 may bring underappreciated tailwinds. And here’s the interesting part: the bar for bonds to outperform is much lower than for equities, which makes them comparatively attractive.

What happened with commodities, currencies, and digital assets

We’ve already discussed the Swiss franc’s appreciation throughout the year. In a world marked by heightened geopolitical tensions, tariffs, and divergent central bank policies, the demand for safe havens was stronger than ever. But this is really just an acceleration of a trend that has been in place for decades. Unless the Swiss National Bank makes another exceptional move to curb it, the strength of the franc is likely to remain a challenge for Swiss investors in 2026.

On the commodities side, metals, especially gold, were the standout performer, with gold surging an impressive 66%. Most other commodities, however, suffered from higher supply and weaker demand, with energy products hit the hardest. The recent actions of the US government in Venezuela may put even more pressure.

Finally, cryptocurrencies disappointed despite a macro environment that seemed supportive: continued institutional adoption, long-awaited regulatory frameworks, and ample liquidity. So why the second wave of indifference toward the end of the year? Was much of the potential already priced in? Perhaps. Were expectations simply too high? Almost certainly. At the very least, this sets a lower base, and maybe more realistic hopes, for next year.

To summarize, 2025 delivered returns in proportion to the noise that surrounded them. The best move was to stay relax and resist the temptation to exit the markets, because giving in would have been costly. Roughly 8%: that’s what a balanced investor would have missed by sitting on the sidelines this year.

On the contrary, by capturing those 8%, we can look at 2026 with more confidence. That gain can serve as a buffer if markets disappoint or as a springboard to seize further upside.

Demystification room: Did Alpian portfolios delivered in 2025?

The transition from one year to the next is always an opportunity to reflect on the time that has passed and how we used it. For portfolio managers, time is money or at least we’re expected to have made you more of it. And even though we invest with a long-term perspective, year-end is when performance comes under the closest scrutiny. Did we manage well? How did we stack up against our peers? Let’s take an honest look at 2025.

For performance comparison, we rely on Performance Watchers, an independent network committed to transparency in Switzerland. Each week, we share our results on their platform and, in return, gain access to anonymized data from hundreds of asset managers and banks. They aggregate these figures to create benchmarks, such as the Mid-Risk Index, which represents the “average” performance of Swiss asset managers for a balanced strategy. For us, it’s a key reference point: underperforming it means you’d have been better off with the average competitor; outperforming it means you were right to trust us.

So how did we do in 2025? For a balanced strategy, we delivered an average performance across all discretionary portfolios of 8.29%, compared to 6.41% for the Mid-Risk Index, a 1.88% outperformance. Since inception, over three years, that brings our total average performance to 21.38%, versus 17.07% for the benchmark, placing us in the top 20%.

Looking at other strategies, 2025 was a strong year overall. While we were slightly behind or on par with competitors for more conservative portfolios, we delivered significant outperformance in more aggressive strategies. Nobody knows what 2026 will bring, but we feel confident that our investment process is robust.

A good moment to take stock

The start of a new year is a natural checkpoint. Not to make bold predictions or drastic moves, but simply to ask the right questions:

Am I organised the way I want to be? Is my money working as hard as it should? Do my financial choices still match my plans for the years ahead?

Whether you already invest, are considering it for the first time, or simply want to better structure your finances, a conversation can help bring clarity. A short call with our Wealth Management Team is an opportunity to step back, get an outside perspective, and turn intentions into a clear plan for 2026 and beyond.

No pressure. No obligation. Just a structured discussion to help you start the year with confidence.

New year, new resolutions, start with a conversation.

)

)

)

)

)

)