This autumn, markets are once again testing their limits. Equities ended September at record highs, bonds found new strength with the Fed’s first rate cut, and gold maintained its shine. When boundaries shift like this, they don’t just move prices, they reshape how investors think about risk and opportunity.

Because if there’s one paradox in finance, it’s that limits are both feared and cherished. Investors rely on them for clarity and confidence, even as markets constantly push against them. The result? A landscape where visibility matters just as much as performance.

And it’s not only markets that work this way. In our personal finances too, boundaries define our choices and sometimes reveal the gaps we need to close. As you’ll see in this month’s newsletter, that’s especially true when it comes to preparing for retirement.

So as we head into October, it’s not only about watching how far markets can push it to the limit, but also about making sure our own limits are prepared for the future.

Table of Contents

- The market at a glance: Sky's the limit

- Key takeaways

- What happened with equities

- What happened with bonds

- What happened with commodities, currencies, and digital assets

- Demystification room: The magnitude of our retirement gap

- The Pillar 3a with 0% management fees* until december 2026

- What you get

- Launch offer

The market at a glance: Sky's the limit

Song of the month: “Sky's the limit" by Notorious B.I.G.

In 1997, The Notorious B.I.G. dropped Sky’s the Limit, an anthem of ambition. As stocks hit new records, we thought this soundtrack was a fitting choice for this newsletter. Markets often share the rapper’s love for aiming high, lavish style, and a taste for gold. Investors, however, play a different tune. They don’t just appreciate limits, they seek to establish them precisely where the market fails to do so.

Still skeptical? Let’s explore this further, alongside our usual market review.

Key takeaways

Investors may cherish limits but markets love to test them. With indices at all-time highs, how should we position our portfolios?

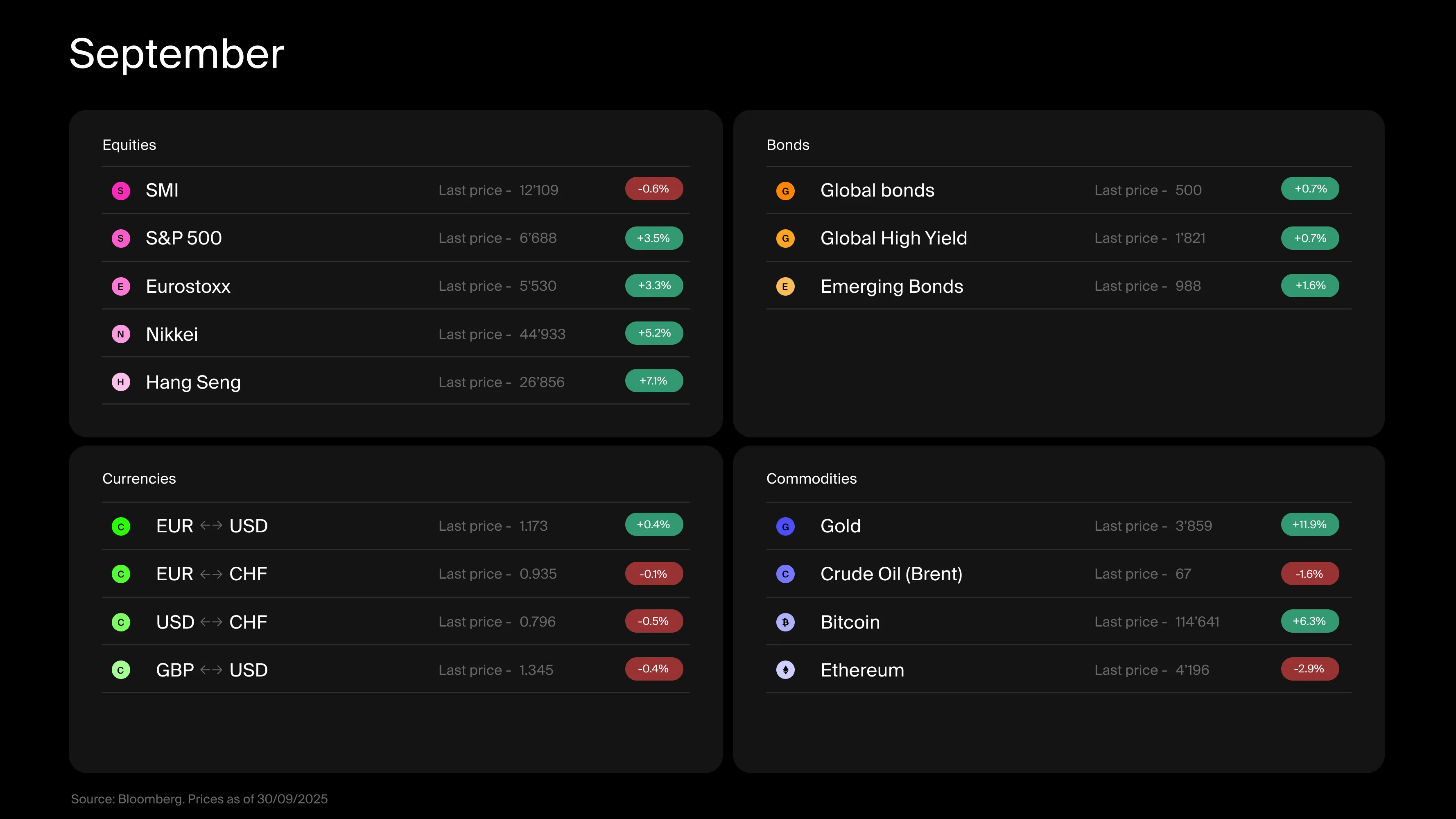

Equity markets closed September in positive territory, with gains that were far from modest..

The Fed’s first rate cut provided a meaningful boost to fixed income markets and sent a strong signal of a potential shift in policy.

Digital assets remain stuck in a slump, while gold continued to shine throughout September.

What happened with equities

Just look at the year so far. The arrival of Trump in the White House sent a chill through the markets. He seemed determined to stress-test every limit, shaking the very foundations of the U.S. economy, unsettling trade partners, central bankers, and political rivals alike.

After a bout of panic in April, investors regained some composure by May, as the contours of the administration’s strategy became clearer and with them, new boundaries.

Some were imposed by the administration itself through fiscal measures (OBBA Act), federal laws (Clarity and Genius Acts), tariffs, and, let’s be honest, a fair amount of arm-twisting (that meeting with top CEOs spoke volumes).

Others were limits the administration ran into: a DOGE project that imploded, supply chains that proved harder to relocate than expected, and global powers showing muscles in the tariff game (and no, I’m not talking about Switzerland).

Boundaries reassure investors. They create a framework, a sense of predictability. When they disappear, volatility tends to rise; when they hold, they offer visibility. And visibility often fuels confidence and markets. The proof is in the numbers: September was great for equity investors and since the start of the year, the S&P 500 is up 14.3%, the SMI 7.7%, and the Hang Seng a staggering 34.6%—far beyond what most investors expected in January.

What happened with bonds

Bond markets are also delivering solid returns, with global bond indices up 8.1% year-to-date, despite a turbulent interest rate environment. While gains in September were modest for developed market bonds, emerging market debt posted strong performance. The widely anticipated rate cut by the Federal Reserve helped lift bond returns during the month and sent a clear signal to markets that the central bank may be shifting toward a more accommodative stance.

Meanwhile, the Swiss National Bank’s decision not to push rates further into negative territory (at least for now), along with the European Central Bank’s consideration of a pause, is providing investors with greater visibility and confidence.

What happened with commodities, currencies, and digital assets

While digital assets and oil saw a slight pullback this month, gold seized another opportunity to shine.

But here’s the paradox: just as the economy regains its footing, markets are venturing into uncharted territory. U.S. equities, and many others in their wake, are trading at historic highs. Gold is at record levels, real estate prices are soaring globally, cryptocurrencies are flirting with their peaks… and debt, like liquidity, is everywhere.

Enough to make investors uneasy. When markets move beyond familiar landmarks, when indicators stop making sense, the reflex is almost always the same: cry “bubble.” And the conclusion seems obvious: it’s only a matter of time before it all ends badly.

In recent weeks, the tone of market commentary has darkened. Analysts brandish charts, warn of froth, and predict, yet again, the imminent arrival of a recession… the same one we’ve been promised since 2022. It will come eventually, just as a market correction is far from unlikely. But the real question is when. And in this game, a timing error can be costly. Miss the last two and a half years, and you’ve left 16% on the table in a balanced portfolio.

Let’s be clear: I don’t claim to be wiser than any other investor. Part of me loves visibility, structure, and reassuring frameworks. But I’ve long known it’s naïve to expect an economy, or markets, to move in a straight line, without overheating or cooling down. Extremes are part of the game. Without them, there would be no risk premium, no opportunity for capital to be reallocated where it’s most productive.

So perhaps it’s time to rethink our approach, in two ways.

First, by seeking out the corners of the market that remain overlooked—those investors haven’t bothered to fence off because they’re simply not on the radar. Today’s geopolitical context offers plenty of these in equity markets, particularly in emerging markets and parts of Southern Europe. And here’s a statistic that should convince even the skeptics: over a single calendar year, 47 national indices (out of 88) outperformed the S&P 500 (in CHF terms), and 67 beat the SMI. Instead of asking whether the U.S. market still has juice, maybe it’s time to broaden our horizons. Stock pickers, too, have compelling reasons to look beyond the usual suspects: year-to-date, the first MAG7 stock ranks only 69th within the S&P 500. And for those less inclined toward equities, attractive opportunities also abound in bonds, commodities, and digital assets—as long as you are ready to leave the beaten path.

Second, by viewing markets and economies not as static systems with fixed boundaries, but as dynamic organisms in constant flux. This perspective changes how we think about diversification. If we reduce it to a simple exercise in spreading capital across asset classes, the outlook is bleak: when everything is at record highs, there are few safe havens left. But if we see diversification as a tool to mitigate the risks of systemic shifts we’d rather not see, it becomes far more strategic.

Hedging can be an effective strategy as well. Instead of trying to predict when markets will correct, or taking the risk of sitting on the sidelines, you can take advantage of lower volatility and stay invested, even in a late-cycle environment. Finally, today’s markets present plenty of opportunities for strategies that don’t rely on taking strong directional bets. Let’s keep in mind that holding cash in Switzerland, where current interest rates are at 0%, is far from the most attractive alternative.

To conclude, limits often make us miserable. As individuals, they constrain us; as investors, we miss them when they’re gone. But maybe the real problem isn’t our inability to locate them, it’s believing they’re fixed in the first place. What if the key to happiness, and fortune, lies in accepting their fluid nature… and mastering the art of letting them come to us?

Demystification room: The magnitude of our retirement gap

One day, you’ll stop working. But when that day comes, your expenses won’t stop. You’ll still need to eat, live somewhere, and enjoy life.

The problem? Most people underestimate how much they’ll need in retirement, and overestimate what their pensions will actually cover.

If you live in Switzerland, your retirement income typically comes from three sources:

1st Pillar – AVS (AHV9 or State Pension): This is designed to provide a minimum income during retirement. Everyone working in Switzerland contributes to it, with both employee and employer paying a percentage of the salary. These contributions don’t go into a personal account—they’re used to support today’s retirees, including our parents and grandparents.

2nd Pillar – LPP or Occupational Pension: This employer-sponsored pension aims to maintain your standard of living after retirement by supplementing the AVS. Contributions are mandatory (unless you’re self-employed) and are shared between you and your employer. The amount increases with age, and unlike the AVS, these funds are set aside specifically for you to access when you retire.

3rd Pillar – Personal Pension Plan: This is optional but highly effective for building retirement savings. You can contribute at your own pace, often with tax advantages. According to the Swiss Federal Statistical Office, nearly two-thirds of employed people in Switzerland have a 3rd pillar account, making it one of the most popular long-term savings strategies.

This system is known as the three-pillar model. And while it sounds solid in theory, the reality is often less reassuring. If you haven’t set up a personal pension plan (the third pillar), the first and second pillars combined typically cover only about 60% of your final salary at retirement. For many, that’s not enough to maintain their current lifestyle.

And that’s assuming a smooth career path. If you’ve worked part-time, been self-employed, taken career breaks, or had gaps in employment—your coverage could be even lower. Planning ahead is how you change that.

The Pillar 3a with 0% management fees* until december 2026

When was the last time anyone got excited about a Pillar 3a?

Probably never.

Most Swiss people face a serious gap at retirement. Can you imagine retiring with 60% of your last salary? Probably not.

This october, we’re launching something unlike anything else in Switzerland: the Alpian Pillar 3a 100% BlackRock | Managed by lemania-pension.

So if you haven’t done what it takes to secure your future, now is the time.

What you get

✓ Close the retirement gap

✓ Save on taxes

✓ Pillar 3a with 100% BlackRock funds

✓ Integrated into your Alpian app (setup in minutes)

Launch offer

Be among the first 1'000 to join and pay 0% management fees* until 31 December 2026. All fees charged during this period will be fully reimbursed. From 2027, only 0.60% per year.

*For 2025 and 2026, all management and foundation fees will be fully reimbursed in December 2026. The following offer does not include the following costs, which remain the responsibility of the investor: VAT, stamp duties, the products’ TER (on average 0.15%), and the subscription/redemption spreads of each product, which are directly reflected in the price of the relevant instrument. Offer limited to the first 1'000 Pillar 3a accounts opened. This communication is for informational purposes only and does not constitute investment, legal, or tax advice. The Pillar 3a solution presented is a tax-qualified retirement savings product subject to Swiss regulatory conditions. Contributions to Pillar 3a accounts may be tax-deductible, and withdrawals are permitted only under specific circumstances defined by law (e.g., retirement, home ownership, or self-employment). Investment strategies within Pillar 3a may involve exposure to financial markets and are subject to market risks, including potential fluctuations in value. Before making any investment decision, we recommend consulting with a qualified financial advisor to assess your individual situation and objectives. iShares® and BlackRock® are registered trademarks of BlackRock Finance, Inc. and its affiliates ("BlackRock") and are used under license. BlackRock makes no representations or warranties regarding the advisability of investing in any product or the use of any service offered by Alpian SA.

)

)

)

)

)

)