For many of us, the back-to-school season comes with a double sting: cooler weather and moody markets. But it’s not the time to let the blues settle in, September is actually the perfect moment to give your finances a little attention.

Whether it’s joining a community, reviewing your portfolio’s past performance with confidence, or making smart adjustments for the fall, this season is all about taking proactive steps.

Wishing you a colourful and financially empowered September!

Table of Contents

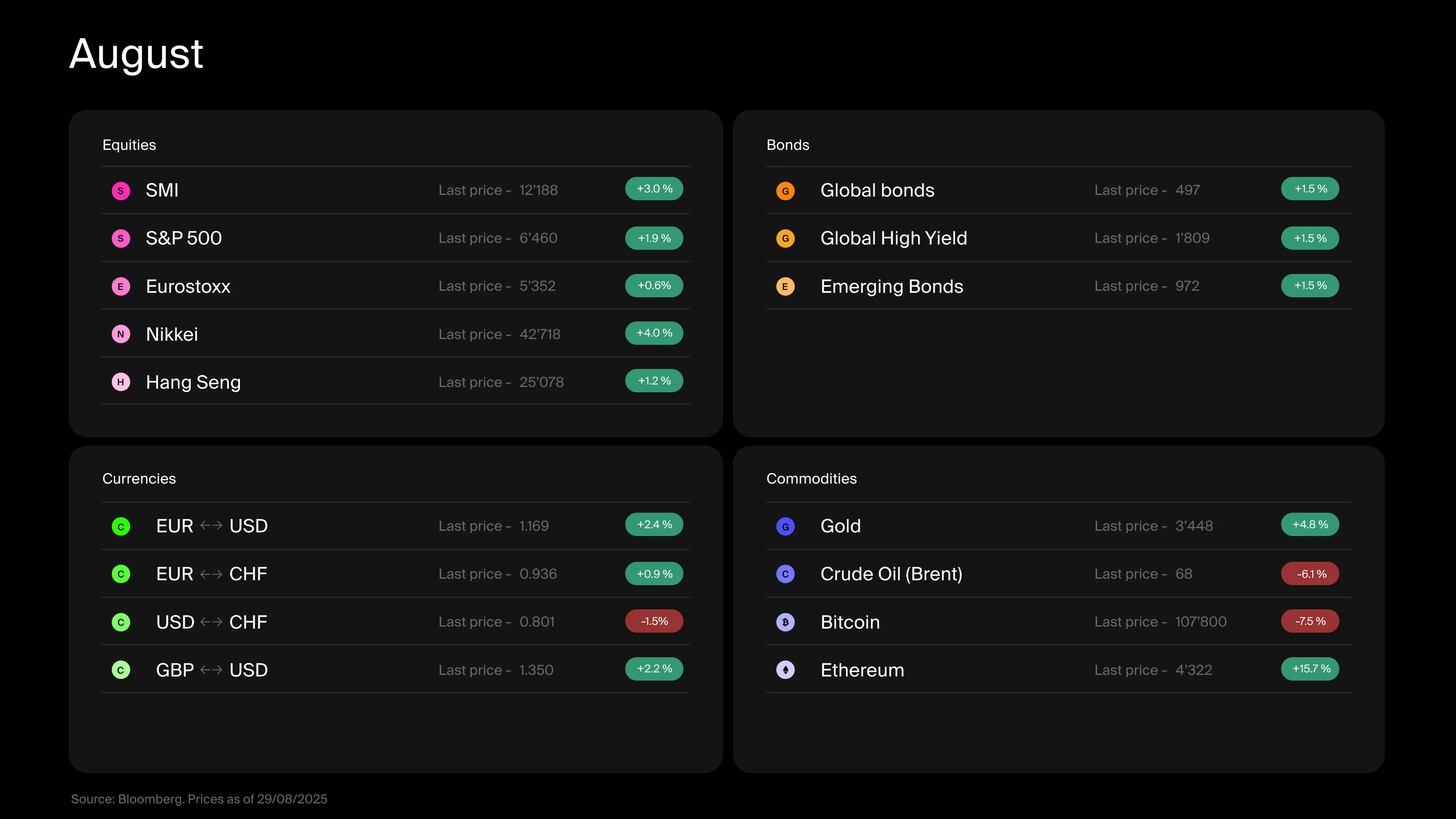

The market at a glance: Under Pressure

Song of the month: “Black or White" by Michael Jackson

After a long search for the perfect soundtrack for this newsletter, I figured a quick trip back to the ’90s was in order. There, I was sure to find a track that could help us face the double whammy of this back-to-work season. Between the gloomy weather and the depressing headlines, it’s hard not to miss our deckchairs. On the markets, gray dominates, a typical shade when opinions diverge and economic data sends mixed signals. So, if we’re going to talk about contrasts, why not do it with a musical twist worthy of the name? Let’s turn up the volume and let Michael Jackson’s Black or White guide us as we try to guess which way the financial winds will blow in the months ahead.

Key takeaways

What will markets bring this fall: green or red? Hard to say when investors see everything in black… or white.

Stock markets ended August in the green but gains were hard-won and momentum faded by month-end

While hopes of lower rates gave bonds a boost, uncertainty persists and the Fed’s dilemma is written all over the markets.

Digital assets remain in the doldrums, while gold is enjoying a strong back-to-school season.

The Swiss franc kept a no-drama stance, at least until the next SNB meeting.

What happened with equities

Looking back at August’s market performance, the overall picture isn’t so bad. Equities ended the summer in the green (S&P 500: +1.5%, SMI: +3.0% in August). On paper, a diversified investor has reason to be satisfied. But the lingering aftertaste is that this progress was hard-won: after a chaotic start to the month, markets caught their breath… only to finish the holiday season visibly out of steam. So, what should we expect in the months ahead? More red or more green?

Hard to say. Right now, the markets seem to be thinking in black and white. On the economists’ side, a consensus is forming around a slightly darker outlook. The impact of tariffs on consumer prices and inflation is starting to show, even if the magnitude remains well below initial fears (on average, about +1% for every 10% in tariffs, according to a Harvard study). The labor market is also flashing signs of weakness, reinforcing the likelihood of a recession.

Investors, however, are leaning toward white, with three reasons to stay optimistic: consumers are still spending, artificial intelligence continues to support growth, and the prospect of a rate cut as early as September is on the horizon.

What happened with commodities, currencies, and digital assets

What happened with bonds

In August, bonds managed to claw back a few basis points as the outlook began to clear. After more than two years of restrictive monetary policy, Fed Chair Jerome Powell has hinted that it may be time to shift course, though his tone still carries a note of caution. For months, the U.S. central bank has been walking a tightrope: continue fighting inflation, even at the risk of drawing Trump’s ire and straining public finances, or pivot toward supporting growth. Black or white, plague or cholera…

This dilemma is mirrored in the bond markets and even in the shape of the yield curve - the line that shows interest rates for short-, medium-, and long-term bonds. Normally, this line slopes upward because investors expect to earn higher returns for locking in their money for longer periods. But now it looks unusual: short- and long-term rates are high, while medium-term rates have dropped (Think of it like this: you’d ask for 4% to lend money to your cousin for 1 year or 10 years, but only 3.5% for 5 years, strange isn’t it?). This ‘butterfly’ shape signals that investors are uncertain about the future, whether due to shifting economic policies, changing conditions, or an expected transition in the market.

In Europe, expectations are that interest rates will remain unchanged through year-end, while in Switzerland, all eyes are on the Swiss National Bank for guidance in the coming week. Meanwhile, the government is seeking ways to persuade President Donald Trump to lower his 39% tariff on Swiss goods, a measure impacting nearly 60% of the country’s exports. Should the SNB venture back into negative rate territory, it would be a double blow for Swiss investors. For now, markets aren’t pricing in such a move, but with a new SNB chairman known for surprises, nothing can be ruled out.

What happened with commodities, currencies, and digital assets

The back-to-school season seems to be having mixed effects on commodities and digital assets. While Bitcoin is dragging its feet and oil continues to trade sideways, gold is enjoying a strong run. Yet another set of conflicting signals for investors to decipher. On the currency front, there’s little to report, at least the Swiss franc hasn’t seen a sharp appreciation over the summer.

To conclude, there’s no shortage of diverging opinions right now on markets but they mirror the deep divide surrounding the future of U.S. policy and its geopolitical ripple effects. Once again, the split couldn’t be starker: on one side, those who denounce Trump’s actions and warn of a potential slide toward an authoritarian drift reminiscent of some emerging markets; on the other, those who hail him as a hero. As for Trump himself, he remains true to form. Black or white, he continues to impose tariffs—both literally and figuratively—on anything that stands in his way: trade partners, political and financial institutions, and even heads of state.

Such polarized views often translate into short-term volatility in the markets, but they can also create valuation gaps that present opportunities. I’ll admit it: as a finance professional, I find these periods far more intellectually stimulating than a market dominated by consensus. We may not have a crystal ball to predict whether black or white will prevail, but we can adjust portfolios so we don’t have to pick a side.

The first approach: embrace the shades of gray. Diversification has never been more relevant, on every level. Geographically, many countries outside the major powers are finding ways to shine. Even within certain blocs, like Europe, dynamics are shifting: former “problem children” are becoming role models. Then there’s diversification across asset classes: uncertainty means different risk premiums, and broadening horizons can pay off.

The second approach: bet on both black and white. For example, position for a market rally while maintaining hedges, or play the extremes within the same spectrum.

The range of options is endless once you reframe the problem. To borrow from Michael Jackson, black or white—the color doesn’t matter. What matters is adjusting your perspective and your portfolio. And with that, I wish you a colorful start to the season.

Demystification room: Alpian’s performance under microscope

Next month marks our 3-year anniversary, a milestone that invites reflection as much as celebration.

Since launching our discretionary mandate in 2022, we’ve remained committed to delivering consistent, risk-adjusted returns while maintaining cost efficiency and transparency. But how do we stack up against established players in the Swiss market?

To find out, we conducted a performance study using Performance Watcher and a panel of Swiss asset managers. The results are encouraging. For a balance strategy:

We ranked in the top tier.

We delivered, on average, an additional 4.5% net of fees compared to the Performance Watcher Mid-Risk Index since launch.*

Click here to read the full story.

Join SheWealth…

This next story might resonate with your wives, mothers, sisters, daughters, nieces, goddaughters and even your grandmothers!

In a university research lab, an economist asks a simple question about investment diversification. The men raise their hands confidently. 63% of the women whisper “I don’t know” and look away. Intrigued by this pattern, the researcher repeats the experiment. This time, there’s only one rule: no “I don’t know” option, everyone must choose. The result is astonishing: correct answers among women jump by 14%.

They knew. They’ve always known.

This discovery reveals a silent tragedy. In Switzerland, only 32% of women invest, compared to 48% of men. Globally, this simple confidence gap costs 2,600 billion CHF, money sitting in savings accounts instead of growing in the markets.

That’s where SheWealth.ch comes in, not just a financial education platform, but a quiet revolution. An English-speaking community supported by Alpian and SmartPurse, with tennis player Belinda Bencic as ambassador, it transforms “I don’t know” into “what if I tried?”

In this judgment-free, jargon-free space, women’s natural caution becomes a competitive advantage. More women investors means more stable markets and an additional 1,500 billion CHF in ESG investments.

This positively impacts Switzerland’s economic growth and helps families become more financially prepared.

If you’re a woman: when will your first “I think I can…” be?

If you’re a man: encourage the women around you to explore this community.

* Content of this publication is for informational purposes only, you should not construe any such information as legal, tax, investment, financial, or other advice. Any performance figures displayed account for the aggregate performance, net of fees, of all clients at Alpian with a Balanced Strategy. Individual investment returns may differ due to a variety of factors, including, but not limited to, the date of investment and the investment strategy employed. Past performance is not a guarantee of future return. The data was gathered from the providers' websites and the most up-to-factsheet available as of July 31st, 2025. While we strive to ensure the accuracy and completeness of the information presented, we are not responsible for any errors, omissions, or changes in the data provided by the banks. The findings and conclusions of this study are based on the data available at the time of analysis and may not reflect current conditions. We do not assume any liability for decisions made based on this study. Readers are encouraged to verify the information independently. Fees are subject to change at the banks' discretion.

)

)

)

)

)

)