With summer in full swing, investors hoped for calm and, surprisingly, they got it. July brought sun, serenity, and positive returns across most asset classes. But when markets behave so well despite geopolitical noise, one question naturally arises: is this the start of something real, or just an illusion?

In this month’s edition, we explore what’s behind the market’s summer resilience. Is Trump’s economic vision finally taking shape? What’s happening with bond yields, and why are digital assets making a comeback? We also unpack the growing relevance of stablecoins and what their rise could mean for the global dominance of the U.S. dollar.

Enjoy the read!

Table of Contents

The market at a glance: Under Pressure

Song of the month: “Just an illusion" by Imagination

It’s a ritual every investor performs, regardless of their management style, religious beliefs, or convictions. On the eve of their summer break, they whisper a silent prayer to the gods of financial markets:

“Please, let nothing disturb my vacation.”

I’m no exception. Two weeks ago, I too bowed to this tradition. And I must admit, I wasn’t displeased to see Trump’s early July prophecy “Markets are at their peak, and we’ll make sure they stay there” come true. It’s always more pleasant to glance at your phone from a sun lounger and see markets climbing.

Of course, relying on market gods or presidential promises isn’t a viable long-term strategy. Their mercy is fickle, and living in a dream for too long is never wise. Markets at record highs despite a fresh wave of tariffs? Is it just an illusion, or something more durable? That’s the theme, and musical reference, as you may have guessed, of this newsletter.

Key takeaways

Investors prayed for calm during their summer break and markets delivered so far. Despite geopolitical noise, equities stayed resilient. Just an illusion or or the start of something more lasting?

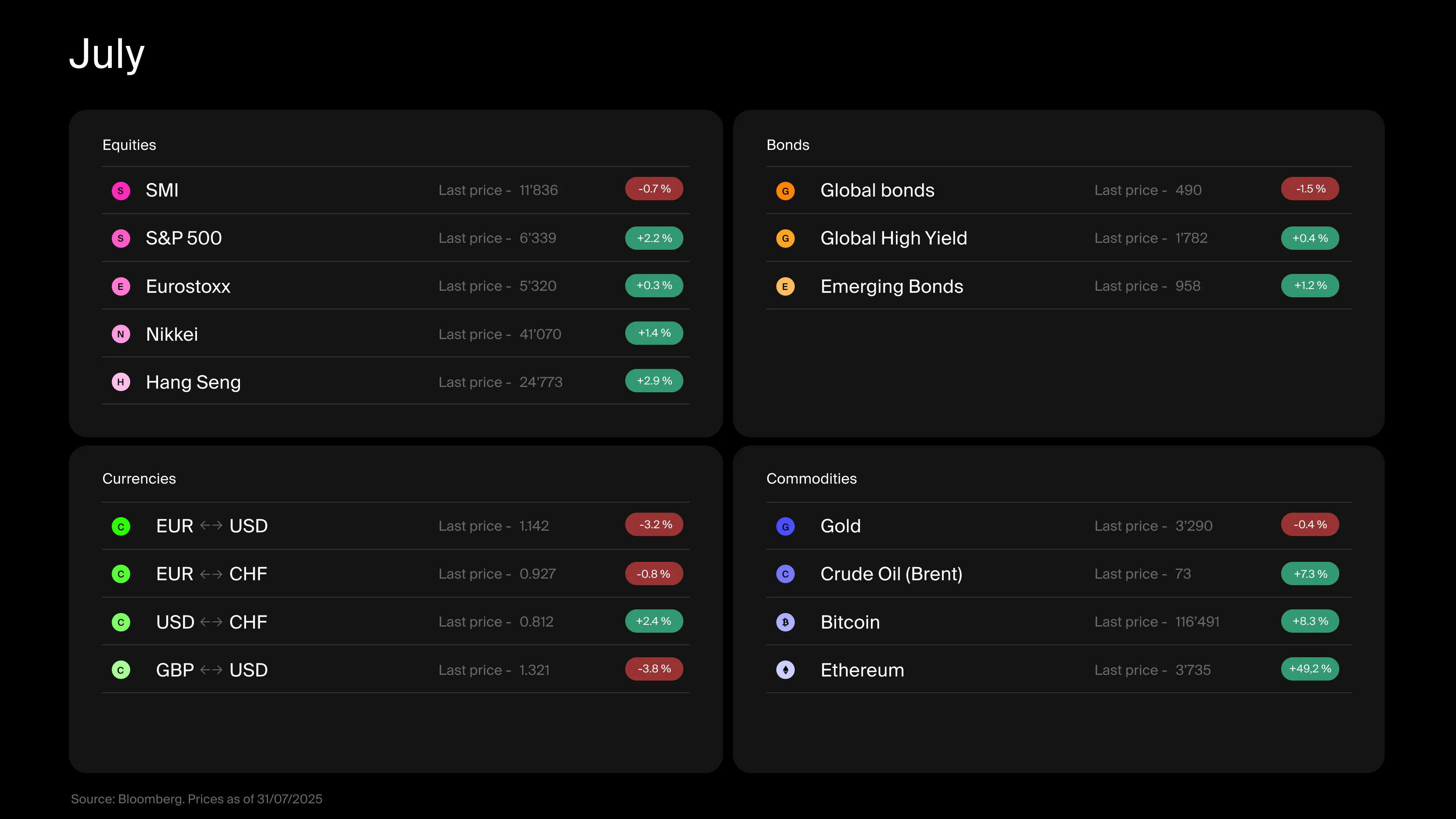

U.S. stocks hit new highs, while Europe and Switzerland lagged behind but still posted positive returns in July.

Trump’s economic strategy is becoming clearer, centered on tax cuts, tariffs, and pressure on the Fed to lower rates. But the Fed is holding its ground, and bond yields remain volatile.

Digital assets are back in the spotlight: Bitcoin rose 8.3%, Ethereum surged nearly 50%. Oil rebounded, while gold took a breather.

The Swiss franc weakened slightly against the euro and dollar, a welcome shift for international investors.

What happened with equities

Let’s start with a quick performance review. As of writing, the S&P 500 is at an all-time high, following nearly three months of uninterrupted gains. Most other equity indices have followed suit, and emerging markets are also showing strong performance. Europe and Switzerland are struggling to keep pace, but July was broadly positive. The takeaway? Investors seem to have made peace with the tariff game.

Politicians, exporters, and journalists, however, are far less enthusiastic. The deal struck between Trump and the European Union leaves a bitter aftertaste. A trade war may have been avoided, but at what cost? The EU now faces a 15% base tariff on nearly 70% of its exports to the U.S., commits to $600 billion in U.S. investments over three years (about $1,300 per European annually), and pledges to purchase $750 billion in U.S. energy products. No wonder European leaders are facing media backlash.

While the deal is broadly unfavorable to the EU, let’s dispel a few illusions:

Who pays the tariffs? Exporters? Importers? American consumers? Economic research is clear: it’s typically importing companies and consumers who bear the cost. That’s why the U.S. administration often favors moderate tariffs (10–15%) as a negotiation tool.

Energy purchases: The EU’s promise to double its U.S. energy imports seems unrealistic given limited supply, technical constraints, and the EU’s limited influence over private companies. The only truly binding commitment is the massive investment pledge.

As for Switzerland, we’re still waiting to see how we’ll be affected, verdict expected on the Swiss side, we’re still waiting to find out what kind of deal we’ll be served. After an initial announcement on August 1st of a 39% tariff, more like a fireworks display than a policy, it’s likely that new negotiations will soon be underway. To be continued.

What happened with bonds

One reason the U.S. market may be regaining its pre-election momentum is that the Trump administration’s strategy is becoming clearer. The illusion of chaos is fading, revealing a delicate triangulation:

Rebuild the economic model and stimulate growth.

Contain the national debt and its cost (currently a staggering $37 trillion).

Preserve the dollar’s status as the global reserve currency, which gives the U.S. undeniable advantages on the world stage.

The first goal was achieved through the OBBBA (One Beautiful Big Bill Act), a sweeping law that consolidates fiscal, budgetary, and social measures, forming the backbone of Trump’s second-term economic agenda.

The second goal involves a mix of tariffs and a standoff with the Federal Reserve, aimed at pushing interest rates lower. So far, the Fed and bond markets are holding firm. Investors generally believe that current U.S. rates, though high, accurately reflect the risks of lending to a government that may introduce new tax breaks and inflationary tariffs. Trump, of course, disagrees, arguing that rates should be much lower. It’s worth remembering that high rates make it harder to finance the government’s massive debt.

As long as this tug-of-war continues, bond yields will remain volatile.

The third goal, preserving the dollar’s dominance, deserves closer attention.

What happened with commodities, currencies, and digital assets

To achieve its third objective, the administration is leveraging two regulatory frameworks governing cryptoassets. At first glance, these rules might seem designed to curb crypto growth. But the strategy is more nuanced: it’s about re-centering the dollar within the digital asset ecosystem.

If, by decree, certain cryptoassets (like stablecoins) must be backed by U.S. dollars or Treasury bonds, then demand for those assets would automatically drive demand for the dollar and Treasuries, reinforcing their global status. Loosen banking restrictions, sprinkle in some innovation, and the trick is complete.

In any case, cryptocurrencies are thriving. Bitcoin is up 8.3% this month, but it’s Ethereum that’s stealing the spotlight with a nearly 50% surge.

In commodities, oil is gaining momentum amid stronger demand, while gold is catching its breath after a strong run.

On the currency front, the Swiss franc has slightly weakened against the euro and the dollar, a modest retreat that could prove beneficial for international investments.

To conclude, the financial markets remain heavily influenced by announcements from the U.S. president. There’s no guarantee his strategy will succeed. But investors seem to welcome the emergence of a more coherent, measurable, and time-bound vision. And if corporate earnings for the second quarter remain broadly positive, that could continue to support equity markets. A selective approach will still be necessary to identify the markets most resilient to Donald Trump’s strategy. It may also be wise to take advantage of the current low volatility to implement protective measures within portfolios. For now, the outlook isn’t too unfavorable… at least until the next illusion !

Demystification room: What are stablecoins and why do they matter?

Stablecoins are a type of digital currency designed to do something most cryptocurrencies can’t: stay stable. While Bitcoin and Ethereum can swing wildly in value, sometimes gaining or losing 10% in a single day, stablecoins are built to maintain a fixed value, usually tied to a traditional currency like the U.S. dollar or the euro.

Think of them as the digital equivalent of a dollar bill, but programmable and transferable 24/7, across borders, without needing a bank. For example, if you hold 1 USDC (USD Coin) or 1 USDT (Tether), it’s meant to always be worth exactly $1. These coins are backed by real-world assets, like cash in a bank account or short-term U.S. government bonds, so that users can trust their value won’t suddenly drop.

Stablecoins are incredibly useful. They allow people to send money instantly, avoid the volatility of other cryptocurrencies, and access financial services even in countries where the banking system is limited or unstable. They’re also widely used in crypto trading, where investors move in and out of riskier assets without converting back to traditional money.

But as stablecoins grow in popularity, governments are stepping in to make sure they’re safe and well-regulated. In the U.S., two major legislative efforts, the Genius Act and the Clarity Act, aim to bring stablecoins under clearer legal frameworks. These laws don’t seek to ban stablecoins; instead, they want to ensure that stablecoins are backed by safe, reliable assets like U.S. dollars or Treasury bonds, and issued by companies that follow strict rules.

Why does this matter? Because if stablecoins are widely adopted and legally required to hold U.S. dollar-based reserves, they could reinforce the global role of the dollar in the digital economy. Every time someone uses a stablecoin, they’re indirectly increasing demand for U.S. dollars and U.S. debt, helping the U.S. maintain its financial influence worldwide.

In short, stablecoins are more than just a crypto tool. They’re becoming a cornerstone of digital finance, a strategic asset for governments, and a bridge between the old and new worlds of money.

Get the American Express Platinum Card® at the best condition

As an Alpian client, you get more from the American Express® Platinum Card. Apply through Alpian and unlock exclusive benefits tailored to elevate your everyday:

75'000 Membership Rewards Points (instead of 45'000)

CHF 200 Alpian bonus

50% off the first-year fee

And of course, you’ll also enjoy all the premium benefits that come with the American Express® Platinum Card:

Access to 1'400+ airport lounges worldwide

Concierge services to handle every request

Comprehensive travel and purchase insurance

Start enjoying the privileges of premium banking and premium living.

American Express Platinum & Alpian, everything your wallet needs

)

)

)

)

)

)