January didn’t ease us into the year. Markets moved quickly, opinions even faster, and confidence proved more fragile than many expected. Equities hesitated, currencies stole the spotlight, and assets that had felt untouchable only weeks ago began to wobble.

But is this really a surprise? A change of year does not necessarily mean a change in scenery. The forces shaping markets remain, at their core, strikingly familiar. That is exactly what we set out to unpack in this edition.

In the Demystification Room, we revisit a timely topic: gold, and the real drivers behind its recent rise.

Finally, as markets remind us how quickly sentiment can shift, we also turn to a quieter form of discipline: recurring 3a contributions. Not as a reaction to volatility, but as a way to stay invested methodically, regardless of the market’s mood.

Enjoy the read.

Table of Contents

- The market at a glance: You know I'm no good

- Key takeaways

- What happened with equities

- What happened with bonds

- What happened with commodities, currencies, and digital assets

- Demystification room: Why has the price of gold risen so much?

- Jewelry

- Technology

- Central Banks

- Investment

- Turning discipline into a habit

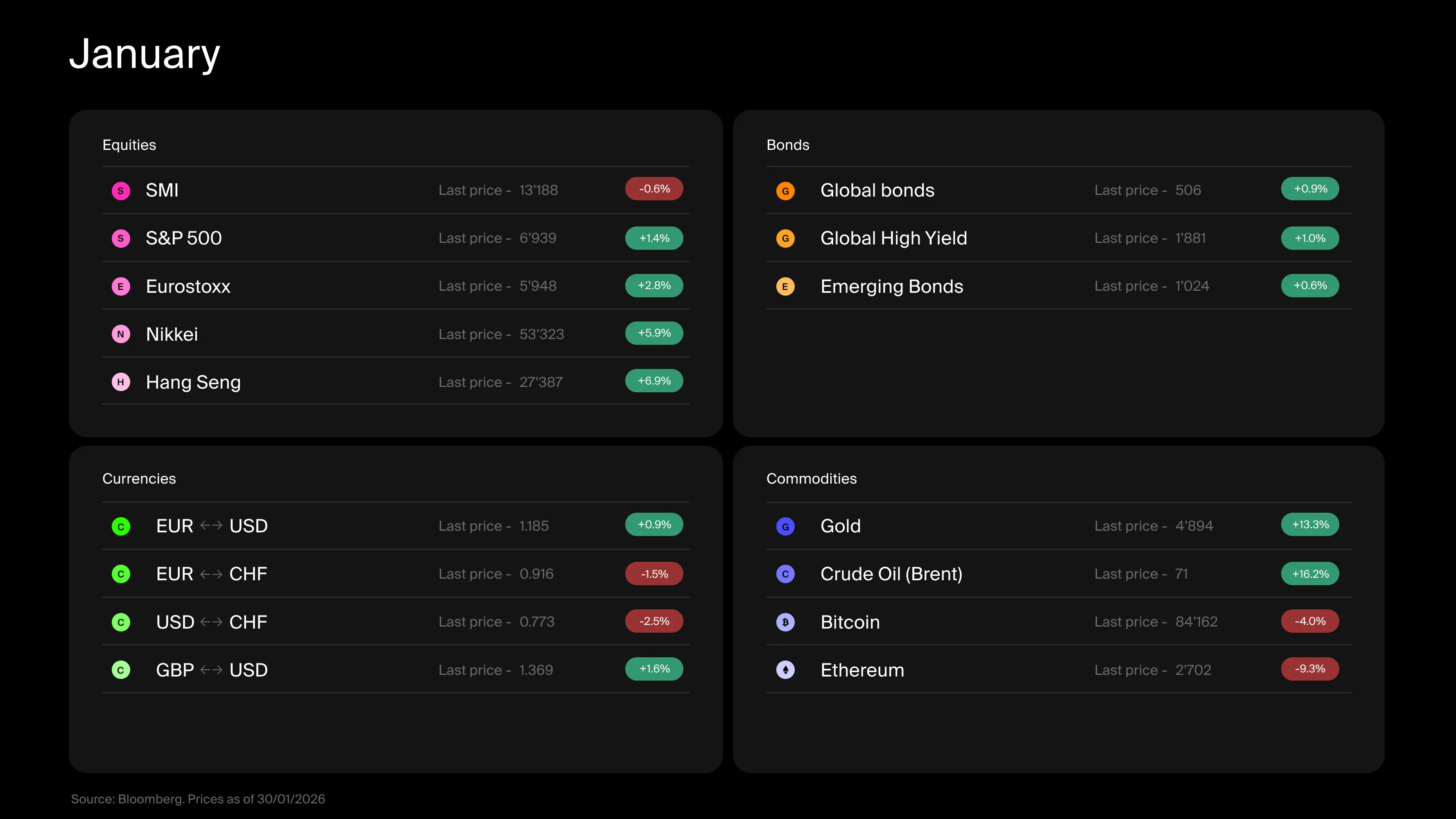

The market at a glance: You know I'm no good

Song of the month: “You know I'm no good" by Amy Winehouse

While personal confessions are common in music, it is far rarer for an artist to devote an entire album to laying themselves bare, even in the most uncomfortable corners of their life. That is precisely what Amy Winehouse did in 2006 with Back to Black. From the opening track, she lays her addictions on the table, before moving on to You Know I’m No Good, where she admits her self‑destructive behavior and infidelity while justifying them through a form of brutal honesty: her partner knew, from the start, what he was getting into.

After the Davos we just experienced, I could not think of a better soundtrack for this commentary.

Key takeaways

A turbulent start to the year for financial markets but the causes are not exactly mysterious.

Equities ended the month lower, and the relentless strength of the Swiss franc has done little to help Swiss-based investors.

Bonds, by contrast, are holding up well in January. And the headline of the month: the name of the future head of the world’s most important central bank is now known.

In the crypto space, the downturn continues. As for precious metals, after a rise that seemed unstoppable, the first signs of turbulence are emerging. Should anyone really be surprised?

What happened with equities

Markets began the year full of good intentions. They didn’t last long. The Swiss equity index finished January slightly lower. U.S. and European markets did a bit better but for Swiss investors that advantage largely disappeared once currency effects are taken into account.

Economic data remains relatively solid, and the first fourth‑quarter earnings releases have been encouraging. Yet sentiment turned sour in the second half of the month. The reason is familiar: geopolitics..

Relations with the United States have grown more tense. Trump’s speech at Davos, debates around Greenland, and the usual flurry of diplomatic theatrics did nothing to calm nerves. Over the past two decades, international politics has increasingly resembled a reality show, except with higher stakes.

That said, if we set aside the theatrics (not easy, I admit) and focus on substance, the surprise is limited. Diverging interests between Europe and the U.S. on trade, security, and alliances have been building for years. And Trump’s style is anything but a surprise.

That said, recent weeks do mark a turning point. Europe has hardened its stance and appears less willing to tolerate certain excesses from the U.S. administration. Several measures have been floated, some more credible than others, ranging from anti‑coercion instruments, to the threat of reducing exposure to U.S. Treasuries, to the negotiation of an unprecedented trade agreement with India (which was swiftly followed by tariff relief from the U.S.).

Other countries are also keeping their distance, as illustrated by the relative discretion of China and other major powers at the most recent Davos Forum. The backdrop is changing, slowly but surely, and increased volatility in equity markets should be expected.

From an asset‑allocation perspective, the key takeaway is that international diversification likely still has a long future ahead of it. As the global order continues to evolve, it is legitimate to question whether limiting the “non‑U.S.” allocation to around 30% within global equity indices remains appropriate.

What happened with bonds

On the bond side, the start of the year has been relatively positive. The major development in recent weeks has been the likely appointment of Kevin Warsh as head of the U.S. central bank, the Fed, an announcement that has naturally raised questions.

In recent months, President Trump has openly targeted the current Fed leadership and sought to influence central‑bank decisions. The objective is clear: lower interest rates to reduce America’s overall “monthly payments.” Yet Kevin Warsh does not, on paper, appear to be the most obvious candidate for this agenda, or at least not the one most closely aligned with the president’s philosophy. His profile is that of a traditional central banker, favoring a disciplined and restrictive monetary policy.

But does this really make a difference in practice?

While the Fed Chair sets the direction, the central bank remains a collegial institution, constrained by the economic and political environment. And when one inherits a balance sheet of nearly 6 trillion, a heavily indebted economy, and inflation still above target, the room for maneuver is limited regardless.

In any case, markets have already taken a stance: they expect interest rates to remain elevated.

What happened with commodities, currencies, and digital assets

According to the press, the nomination of X triggered the recent decline in gold prices. The link is, at best, debatable. It seems far more likely that the market simply seized a convenient opportunity to take profits on assets that had been heavily driven by speculation.

Gold was last year’s superstar, dragging other precious metals along for the ride. I am always amused by how quickly investors turn into overnight experts in metallurgy. The fundamentals, however, are not complicated. The surge in prices was driven primarily by financial demand, the most speculative part of the market (see our Demystification Room). No one can claim they didn’t see it coming.

On the currency front, Davos helped push the Swiss franc to fresh highs, great news for travelers, less so for portfolios.

Finally, in digital assets, the picture is bleak. Bitcoin continues to slide, and the explanations put forward are so unconvincing that the most plausible conclusion is a broad‑based sell‑off, of the kind markets have experienced many times before. Brace yourselves.

Overall, this start to the year may feel chaotic, but the underlying forces are remarkably familiar. To borrow from Amy Winehouse, we can either pretend to be shocked by what we already knew, or accept reality and invest accordingly.

Personally, I choose discipline over selective memory.

Demystification room: Why has the price of gold risen so much?

If there is any remaining doubt about what is really driving the surge in gold prices, let’s dispel the suspense right away: it is speculation.

The World Gold Council publishes a quarterly breakdown of gold supply and demand, allowing us to identify who is actually moving prices. Let’s revisit the four main components of demand.

Jewelry

Jewelry typically accounts for around 50% of total demand. This component is clearly countercyclical: when prices rise too much, demand falls. The intuition is simple, people think twice before buying a gold ring when it becomes significantly less affordable. In 2025, jewelry demand declined by 19%.

Technology

Technological uses represent roughly 8% of demand. The logic here is similar: as gold prices increase, industrial users look for substitute materials in order to protect their margins. In 2025, technology-related demand edged slightly lower (‑1%).

Central Banks

Central banks are often at the center of the debate and account for around 14% of total demand. While they are structural holders of gold, their purchasing behavior closely resembles that of large institutional investors who remain sensitive to price levels. In 2025, central-bank demand fell by 21%.

Investment

This is by far the most volatile component and the one most closely correlated with the price of gold. When gold rallies and dominates headlines, retail investors and asset managers rush into bars, coins, and ETFs. In 2025, investment demand surged by 84%!

So here are the facts: in 2025, gold prices jumped 44% even though demand from jewelry, technology, and central banks all declined. The only segment that surged was speculative investment. The conclusion is hard to miss: speculation. You don’t need to be an economist to see it.

Can gold prices go even higher? Of course. But the higher they climb, the more non‑speculative buyers are likely to step back. And when the reversal eventually occurs, investment flows could amplify the move on the way down, just as they amplified it on the way up.

Turning discipline into a habit

Periods of market turbulence have a way of exposing investor psychology. When headlines are loud and prices swing, the temptation is either to overreact, or to freeze. Yet history suggests that long-term outcomes are rarely driven by dramatic decisions made in moments of stress, but by quiet, repeatable discipline applied over time.

This is precisely where structure matters more than conviction. With the Alpian pillar 3a, you can now take this one step further by setting up recurring contributions to your 3a, allowing you to gradually reach the annual maximum .

In an environment where volatility feels like the norm rather than the exception, automating part of your investment effort can be a way to stay invested without staying emotionally involved.

)

)

)

)

)

)