The world feels like it’s on fire, quite literally, with the heatwave in Switzerland. But also figuratively, as conflicts in the Middle East have escalated to levels of violence we’d expect to shake the markets. And yet? Nothing. Ice cold.

This month, we’re diving into how the market has reacted - or not - to recent events. Then, we tackle a question many investors ask themselves: is it better to invest everything at once, or spread it out over time?

And finally, we’re excited to announce a new feature that helps you stay consistent with your investments, whether weekly, monthly, or yearly: recurring investments!

Enjoy the read!

Table of Contents

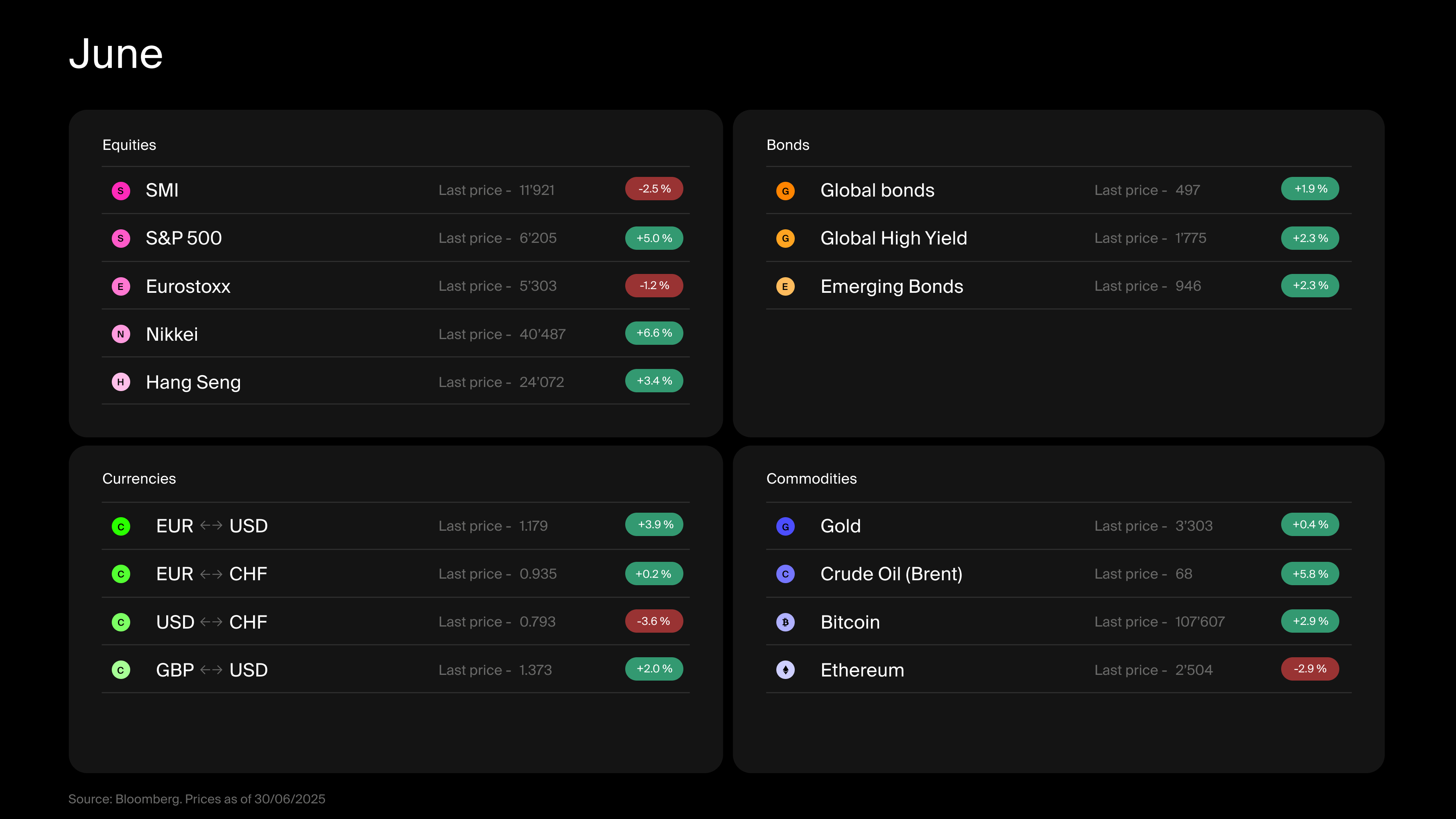

- The market at a glance: As cold as ice

- Key takeaways

- What happened with equities

- What happened with bonds

- What happened with commodities, currencies, and digital assets

- Demystification room: The best way to invest: All at once or over time?

- Putting strategy into action with recurring investments directly in the app.

The market at a glance: As cold as ice

Song of the month: “Cold as Ice" by Foreigner

Ice.

It’s what many of us are dreaming of as the summer heat wraps itself around our days. In our coffee, in our homes and, I’ll admit it, in our holiday plans. This year, my heart leans north, toward the cool calm of Scandinavia, rather than the blazing beaches of the south.

Ice.

It’s also what we hope not to find in the markets, that cold, detached reaction when human lives are at stake. The most striking event this month was, without question, the outbreak of conflict between Israel and Iran, which rattled markets for a few days before things returned to business as usual.

Speaking about financial consequences in the face of human suffering has always felt uncomfortable to me. But over time, I’ve come to accept that part of my role is to provide perspective even when it feels uneasy.

Still, I’m allowing myself a pinch of bitterness with the song that opens this edition: ��“Cold as Ice,” the 1977 classic by Foreigner. A fitting backdrop for a market that shrugs, rebalances, and moves on even as the world trembles.

In this issue, we’ll explore, among other things, what this new Middle East conflict could mean for our portfolios.

Key takeaways

Markets barely flinched at the rising risk of a more violent conflict in the Middle East, cold as ever.

After a brief dip, most equity markets bounced back. U.S. stocks are hitting new highs again, while the Swiss market is still trying to catch up.

The tug-of-war between Trump and the Fed continues, adding drama to U.S. monetary policy. Meanwhile, Switzerland quietly returns to 0% interest rates.

Commodities reacted more strongly to Middle East tensions, spiking before settling down.

Bitcoin is showing signs of life again, while the Swiss franc continues its seemingly unstoppable climb

What happened with equities

As we write these lines, the S&P 500, America’s flagship stock index, is once again approaching its all-time high, having recovered the ground lost since February, and emerging markets posted solid gains. In contrast, European and Swiss equities experienced modest declines. But the early momentum in equities was abruptly interrupted by a sharp escalation in tensions between Israel and Iran.

The Middle East remains a fragile geopolitical fault line, shaped by decades of unresolved conflict and the steady involvement of external powers. The latest flare-up was a stark reminder that uncertainty is almost a permanent feature of the region. Markets initially reacted with alarm when Israeli strikes hit Iran: volatility surged, and risk assets dipped. But what followed was almost textbook.

Looking back at historical market behavior during geopolitical crises (a statistically grim exercise), we see a familiar pattern: an initial equity market pullback, typically around 6% over two to three weeks, followed by a rebound. These reactions tend to be brief unless critical infrastructure is affected, energy supplies are threatened, or the conflict spills beyond its initial borders.

So far, we seem to be following that familiar script. Another U.S. president, another Middle East crisis (and yes, a sobering statistic: not a single U.S. president since 1981 has served a full term without military or strategic involvement in the region), and yet another market rebound after a short-lived dip. While it’s premature to declare the situation resolved, especially with ceasefire negotiations still hanging in the balance, financial markets are already pricing in a return to stability. Even traditional fear indicators such as gold, volatility indexes, and credit spreads show little sustained distress.

That said, we remain cautious. First, the Middle East is a particularly complex arena, with shifting alliances and unpredictable flashpoints. Israel is increasingly asserting itself as a dominant regional power, while Iran faces growing external pressure. Second, any disruption to oil production or key shipping routes could have broader macroeconomic consequences.

Stepping away from the conflict for a moment, let’s turn to another dynamic currently shaping equity markets: a shift in global leadership. Earlier this year, Swiss and European markets were in the spotlight, and many began questioning the long-standing dominance of U.S. equities. But more recently, the momentum has shifted again. U.S. stocks are back in the lead, at least in USD terms, and emerging markets are showing renewed strength. It almost feels like we’ve returned to a pre-Trump-election world. A timely reminder that in markets, the pendulum tends to swing.

For Swiss investors, however, the U.S. comeback is harder to fully appreciate. The continued depreciation of the dollar has weighed on returns. It’s yet another reason why we’ve consistently emphasized the importance of maintaining at least partial currency hedging. That message remains as relevant as ever.

What happened with bonds

June and the first days of July were relatively positive for bond markets. The prospect of lower interest rates helped push bond prices higher. While most central banks around the world have already shifted toward more accommodative policies, all eyes remain on the U.S. Federal Reserve and the iron tug-of-war between Chairman Jerome Powell and President Trump.

Powell has held off on cutting rates, wary that tariffs may end up importing inflation into the U.S. economy. Trump, on the other hand, is pushing hard for lower rates and you can understand why. When your government is carrying a colossal amount of debt, you don’t want to refinance it at high interest. And it looks like Trump may have won this round. First, the Middle East conflict added pressure on the Fed. Second, signs of internal dissent are starting to emerge within the institution.

As Trump looks for ways to remove Powell, whose term ends in just 10 months, we’re also seeing potential successors quietly emerge from within the Fed’s own ranks. Unsurprisingly, those who favor lower rates may find themselves more likely to earn presidential favor. Officially, of course, the Fed is independent.

On the other side of the Atlantic, things are moving more smoothly. In June, the European Central Bank cut rates once again, and the Swiss National Bank (SNB) followed by declaring that a 0% policy rate was appropriate for the Swiss economy.

As for the rationale behind that decision? On paper there are many reasons why the SNB would want to cut rates. Inflation is falling, the economy is expected to slow down, and the Swiss franc is very strong and tariffs are coming our way. In fact, that it’s starting to hurt exports. In May, Swiss exports dropped sharply. In short, the outlook is getting tougher, and a rate cut could give the economy a bit of support.

But here�’s the real question: Will lower interest rates actually help? If we look back at the period from 2015 to 2021, when Switzerland held the title of the world’s most negative interest rates, the impact of low interest rates were mixed:

They helped slow down the rise of the franc, but didn’t stop it.

Foreign investors kept coming, despite the low rates.

The economy grew, but that was also during a time of global growth.

People didn’t necessarily spend or invest more just because rates were low.

Banks saw their profits squeezed.

So, it seems the SNB is going back to a strategy that worked in some ways, but not in all.

What happened with commodities, currencies, and digital assets

If equity markets tend to react to war with the emotional detachment of ice, commodity markets are usually where you find the heat. Traders suddenly have to contend with the risk of supply shocks, especially in energy and raw materials. But this time, the fear was short-lived. In just a few days, we moved from bracing for a cold geopolitical winter to business as usual.

The reaction of gold was particularly telling. Typically, uncertainty sends the yellow metal climbing. But after a strong run over the past year, it seems gold decided to take a breather or perhaps it was simply overshadowed by the rising buzz around cryptocurrencies, which have been enjoying a renewed rally.

In currency markets, the mood hasn't changed much. The U.S. dollar continues its slide, while the Swiss franc keeps climbing, I may well bump into it in Scandinavia at this rate. Since the start of the year, the dollar has lost over 12% against the franc, making international diversification more complicated for Swiss investors.

All in all, June was a relatively strong month for markets, even as the threat of prolonged conflict in the Middle East cast a shadow.

Investors, as they often do, looked past the headlines, so long as the turmoil didn’t directly impact economic activity. Markets are built to be rational, to price risk, not emotion. But that rationality can feel cold as ice, especially when real people are caught in the crossfire. It’s a reminder that while markets move on quickly, the world they reflect is far more complex, and far more human.

Looking for expert investment advice? Schedule your free session with a wealth advisor today.

Demystification room: The best way to invest: All at once or over time?

When you have money to invest, a common question arises: how should you deploy it? Should you invest the entire amount at once, spread it out over time, or wait for the market to dip before entering?

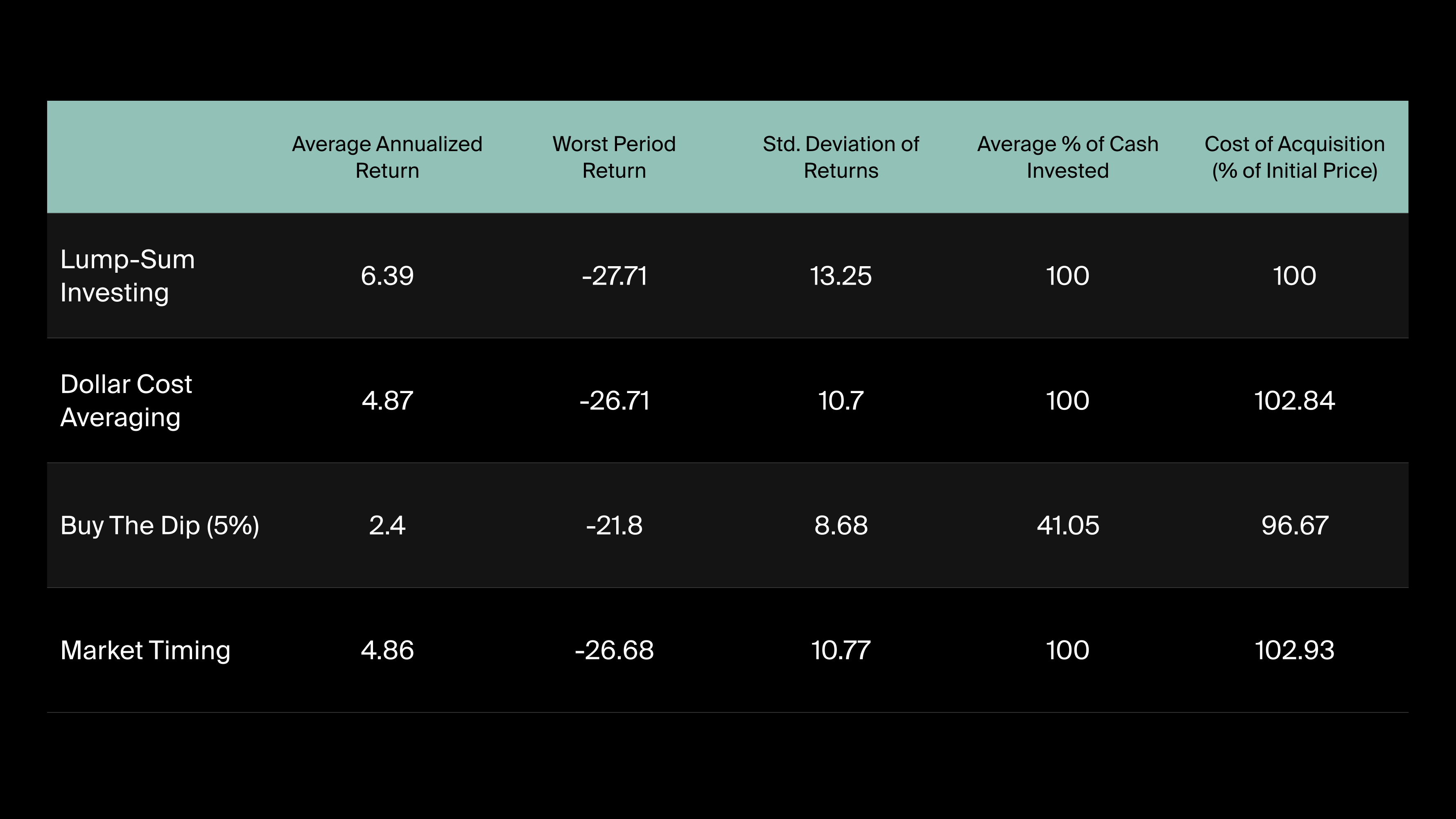

To explore which strategy tends to perform best, we analyzed nearly 37 years of data from the Swiss stock market (SMI), comparing four approaches: investing the full amount immediately, investing gradually through regular contributions (known as dollar-cost averaging), attempting to time the market, and investing only after market declines.

The results showed that investing the full amount at once delivered the highest returns most of the time. However, this doesn’t tell the whole story. In practice, most people don’t have a large lump sum ready to invest. Instead, we typically earn money gradually, through salaries, bonuses, or allowances. That’s why recurring investing, or dollar-cost averaging, often proves to be the more practical and sustainable approach.

This strategy aligns with how we earn and helps maintain a disciplined routine. It allows you to invest consistently over time, reducing the pressure to find the perfect moment to enter the market. It also encourages long-term participation, making it easier to stay invested during periods of volatility.

While strategies like market timing or waiting for dips may sound appealing, they rarely succeed in practice. Predicting market highs and lows is extremely difficult, even for professionals, and many investors end up buying high and selling low. Waiting for dips can also be counterproductive, as markets tend to rise over time and dips are unpredictable. Holding cash while waiting often results in missed opportunities.

Although investing a lump sum may offer the best returns if you have the funds and can tolerate the risk, for most people, recurring investing is the smarter, more realistic choice. It’s steady, simple, and designed to help you grow your wealth over time, without needing to be a market expert. So if you’re wondering when to start, the answer is: now and keep going.

Table 2: Evolution of an investment of CHF 12’000 for four different groups of investors in the period March 1995 – June 2025, adopting strategies of “Lump-Sum Investing”, “Dollar Cost Averaging”, “Market timing”, “Buy the dip”.

Disclaimer: The following investment strategies are hypothetical and intended for illustrative and educational purposes only. They are based on historical performance of the Swiss Market Index (SMI) and do not constitute financial advice or a recommendation to invest. Past performance is not indicative of future results. Lump Sum Investment. The investor allocates the full capital (CHF 12,000) at the beginning of a two-year period and remains fully invested throughout. Monthly Investment: The investor contributes CHF 1,000 at the end of each month during the first year (totaling CHF 12,000), then holds the accumulated investment for the second year. Buy The Dip: The investor deploys capital in two tranches of CHF 6,000 each, but only during months in the first year where the market experiences a decline of 5% or more. If no such declines occur, the capital remains uninvested. Market Timing: The investor makes four random investments of CHF 3,000 each during the first year, then holds the total investment for the second year. The timing of the investments is randomly selected within the first 12 months. These strategies are designed to explore the impact of timing and market conditions on investment outcomes. Actual investment decisions should consider individual financial goals, risk tolerance, and market conditions. Past performance is not a guarantee of future results.

Putting strategy into action with recurring investments directly in the app.

We are pleased to announce our new recurring investments feature.

We are pleased to announce our new recurring investments feature.

By setting a fixed amount to invest at regular intervals, you remove the stress of timing the market and build a habit that supports long-term success. Growing your wealth becomes easier.

Set your amount once, and we’ll take care of the rest. It’s consistent, simple, and always under your control.

Choose the investment solution that suits you best and start investing with a recurring investment:

Essentials : from CHF 2’000

Managed : from CHF 30’000

Whether you're new to investing or ready to take your wealth further, Alpian offers the simplicity and support you need.

Looking for support to choose the right approach? Schedule your free session with a wealth advisor today.

)

)

)

)

)