Your first step into investing, simplified

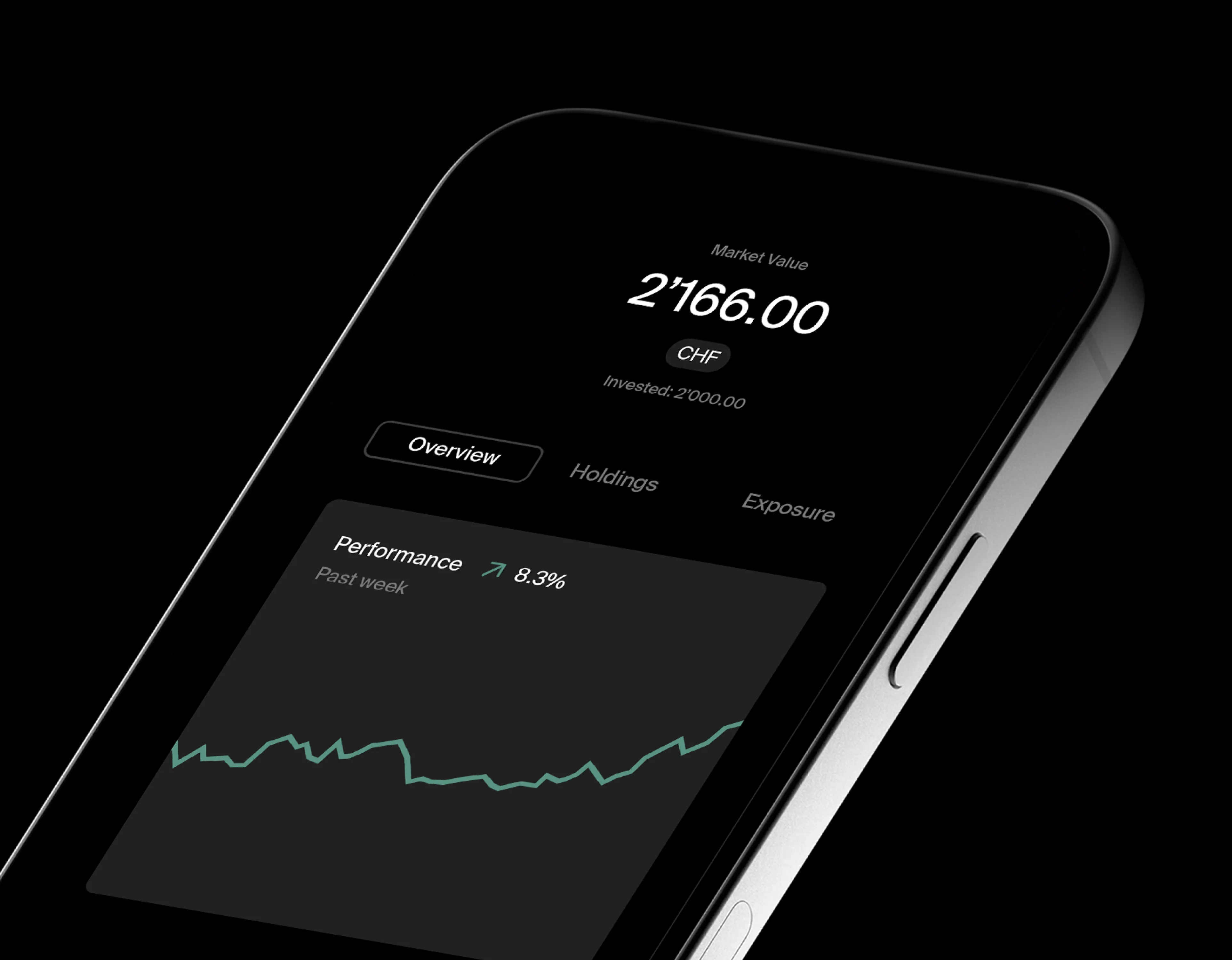

With just CHF 2,000, Managed by Alpian Essentials gives you access to professionally managed ETF savings plans. Ideal if you're investing for the first time or looking for simplicity with clear results.

Effortlessly grow your wealth with professionally managed ETF savings plans.

Plans for every vision

With Essentials, you decide the focus of your investments. Investing sustainably? Focusing on Swiss markets? Adding cryptocurrencies? We have a plan for every vision.

Easy and automated

Decide how much you want to set aside for your ETF savings plan and set up a recurring deposit at the frequency that works for you. Once the funds reach your account, we’ll invest them and keep your portfolio optimised for the best possible returns.

Cost effective

Enjoy premium wealth management at fees up to 40% lower than traditional banks. We select ETFs with attractive pricing and actively leverage our negotiating power to keep your investment costs consistently low, without compromising on quality.

Managed by professionals

Unlike automated solutions, Essentials plans are hand-crafted by Alpian's investment team to capture the long-term growth of the financial markets. Each plan is regularly rebalanced to ensure optimal alignment with your risk capacity.

Choose your investment plan

Swiss plan

Invest with up to 60% exposure to Swiss markets and CHF-denominated assets.

Global plan

Diversify your investment across international markets and asset classes.

Sustainable plan

Invest in companies aligned with ethical standards and strong ESG practices.

Global + Crypto plan

Combine global equities with up to 10% exposure to digital assets.

No hidden costs

Essentials offers simple and transparent pricing. The 0,5%-0,75%% annual fee covers portfolio management, transactions, regular rebalancing, advisory services, and more.

Tailored to your goals

Your portfolio isn’t one-size-fits-all. Essentials matches investments precisely to your unique risk profile, thanks to our comprehensive behavioral-science-based questionnaire.

Balanced for growth

Your portfolio strategically combines diversified ETFs, handpicked by our experts based on historical performance, low fees, and other critical factors, to optimise global market exposure and steadily grow your wealth.

Essentials is perfect for you if:

You’re new to investing and want an easy, reliable way to start.

You’re looking for a cost-effective solution with a low initial investment.

You prefer having experts manage your portfolio instead of going it alone.

You’d like to test Alpian’s investment expertise without high commitments.

Get started in 4 easy steps

To activate your new account, your first deposit needs to come from another account in your name.

Step 1

Open an Alpian account

Just download the Alpian app and open an account—it’s totally free.

We dive into your investment experience and use behavioural science to gauge your risk tolerance.

Step 2

Complete your investor profile

Understand your risk tolerance and investment objectives.

Each of our four plans—Swiss, Global, Sustainable, and Global + Crypto—is available across five distinct risk levels, allowing you to comfortably select a portfolio that matches your specific financial goals.

Step 3

Choose your Essentials plan

After assessing your risk profile, pick the investment plan that aligns best with your vision.

From this point forward, our team will do all the work: selecting investments, executing transactions, monitoring performance, making adjustments and keeping you informed of what's happening.

Step 4

Relax

Our experts manage your portfolio from there.

Automate your investments

Set up recurring investments into your portfolio. Weekly, monthly or yearly. You choose the amount, we handle the rest.

Consistency is power

Investing regularly builds good habit. It becomes automatic and stress-free.

Always the right time

No need to worry about picking the “perfect” moment to invest.

Stay steady

When markets fluctuate, you’re less likely to panic. Automation helps you stay invested.

Which investment plan is right for you?

Conditions and services

Performance

Frequently asked questions

How do I open an account with Alpian?

To open an account with Alpian, begin by downloading the app, available for both iOS and Android devices. During the sign-up process, you will be asked to provide some personal information and complete a quick ID verification to ensure security and compliance.

Eligibility requirements: You must hold a valid Swiss residence permit and provide an original, valid passport or national ID. Please note that photocopies will not be accepted.

Activating your account: The final step to activate your account involves making a deposit that must come from a bank account registered in your name at a licensed bank located either in Switzerland or a FATF country.

Important: Because of FINMA regulations, funds transfers from companies like Revolut, PayPal, or Wise are not accepted.

What specific products are included in Alpian's investment portfolios?

Our management mandates are based on ETFs. To select the ETFs included in our portfolios, we followed a rigorous selection process across 4 sub-asset classes: Fixed income, equities, commodities, and digital assets. Learn more

How does Alpian handle kickbacks and retrocessions?

At Alpian, we prioritise integrity and transparency. We adhere strictly to a policy of not accepting any compensation from third parties that could influence our service to our clients. In exceptional cases where such compensation is unavoidable, we pass the full amount directly to you.

Our collaboration with external advisors, including entities within the Intesa Sanpaolo Group, is conducted with the utmost respect for these principles. We remain exclusively responsible for all investment decisions made as part of our discretionary portfolio management services, as well as for all our investment recommendations. This ensures that our advice is always objective, transparent, and tailored to your unique financial goals and needs.

Can I withdraw my funds at any time?

Absolutely, there are no lock-in periods with your investments at Alpian. You can access your funds anytime, with liquidation typically occurring within two working days after your request.

When you request a withdrawal or close an investment mandate:

For Managed by Alpian / Managed by Alpian Essentials mandates: Orders are executed during the next rebalancing.

For Guided by Alpian: Orders are executed at the next investment cut-off (around midday) after you submit them.

Please note that it takes 2 working days for trades to settle (the exchange of the instrument for cash with our broker). Once settled, the cash will be available to you.

Where are my investments held?

Your investments are held in your name with our custodian, Interactive Brokers. This means the securities (such as ETFs) are legally yours. In the unlikely event of a bank or custodian insolvency, these assets do not form part of their estate and remain protected for you. For 3A assets, the custodian is Reyl – Intesa SanPaolo.

Are my investments hedged, and why?

Yes, our portfolios are primarily hedged in Swiss francs as a default position to reduce currency risk and provide greater stability for Swiss investors. However, this is not systematic: the investment team may take tactical currency views when deemed appropriate. Additionally, for certain asset classes, hedging is not possible. Unlike many competitors whose performance can fluctuate significantly with currency movements, such as euro volatility, our approach aims to deliver a more stable investment experience while retaining flexibility for strategic decisions

Are my investments safe and private?

Alpian, as a bank supervised by FINMA, offers the suite of protections and safeguards inherent to Swiss banks. The protection of your wealth and personal information is our utmost priority.

)

)

)

)

)

)

)

)

)

)

)

)