The question of whether active or passive investing is the better path to reaching your investment goals is widely debated – not just among professionals, but also among investors who aim to take a conscious, long-term approach.

An article by Amandine Soudeille, Associate Portfolio Manager at Alpian, clearly shows that achieving alpha – a return above the market – is possible, but difficult to maintain consistently. Especially in volatile market phases such as 2020 or 2022, many actively managed funds underperformed their benchmark. Only a very small number of funds managed to consistently outperform their benchmark over several years.

In contrast, passive strategies are primarily designed to track the market – with lower costs, broad diversification and less flexibility, but also less effort.

In this article, we explore the fundamentals and differences between active and passive investing, examine which approach tends to perform better in different market environments – and provide you with a foundation for deciding how to shape your own investment strategy.

Table of Contents

- Definition of active and passive investing

- Pros and cons of active and passive investment strategies

- Active investing – pros and cons

- Passive investing – pros and cons

- Cost comparison: active vs passive

- Case studies from Switzerland: successes and setbacks

- Example 1: When active strategies fail

- Example 2: When active investing adds value

- Conclusion: Which strategy is right for you?

Definition of active and passive investing

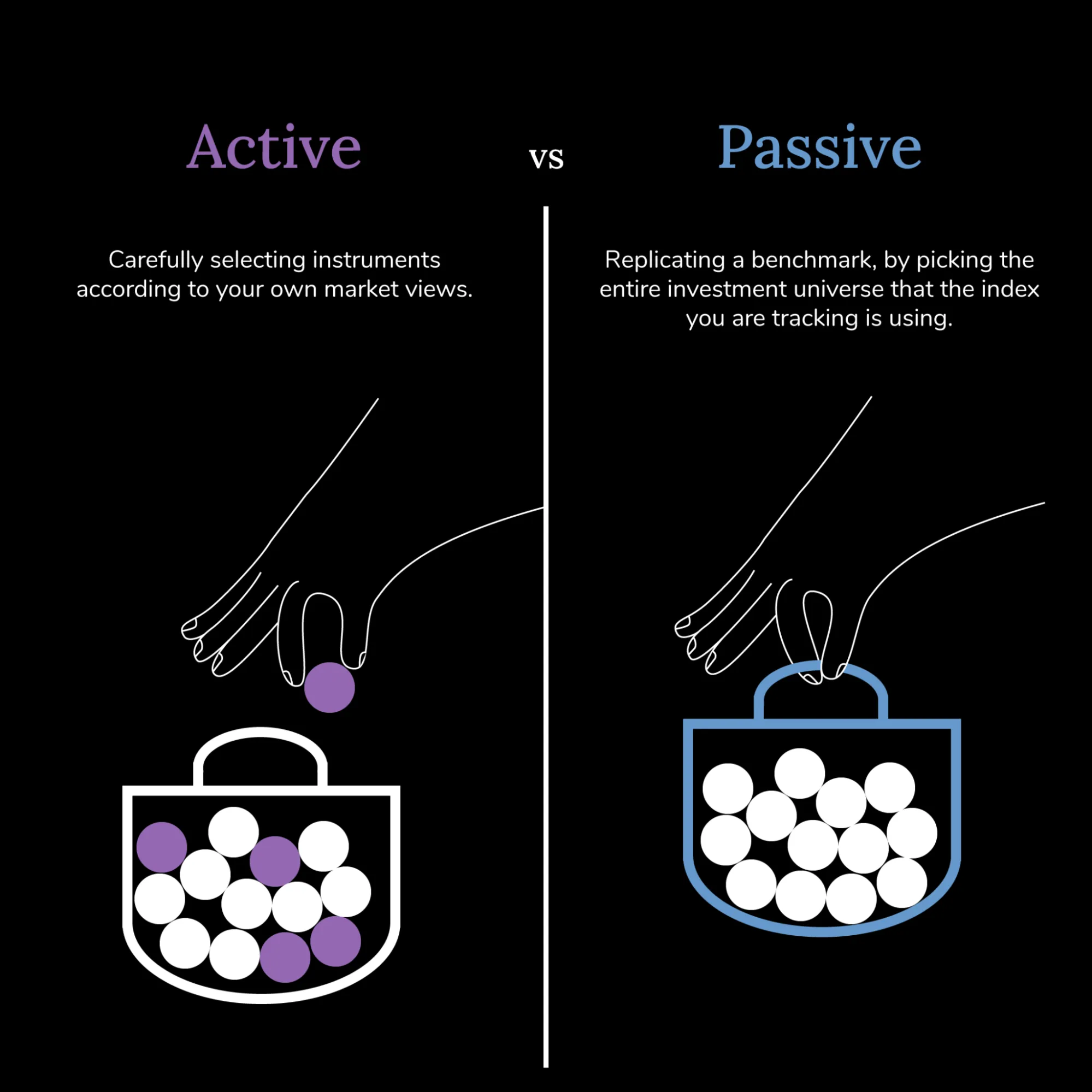

Let’s first define the terms. Passive investing means investing in broad market indices rather than picking individual stocks or market timings. A passive investment product – typically an index fund or ETF – replicates a specific index such as the Swiss Market Index (SMI) or the global MSCI World Index. That means the fund contains exactly the same securities as the index, in the same proportions.

Active investing, by contrast, involves a portfolio management team selecting securities in an effort to outperform the market – in other words, generate alpha. In practice, this is rarely achieved over the long term. An analysis of nearly 6,100 funds available to Swiss investors showed that in “normal” years like 2018 or 2019, around 59% achieved a positive excess return. In more volatile years such as 2020 or 2022, this share fell to just 35–36%.

More tellingly: only around 5% of equity funds have outperformed their benchmark every single year since 2018.

Pros and cons of active and passive investment strategies

How do active and passive strategies differ in practice? Here’s an overview of their key advantages and disadvantages:

Active investing – pros and cons

Pros: Potential to outperform the market with skilled management. Flexibility to react to market changes (e.g. defensive positioning during downturns). Ability to invest in trending themes or niche sectors and benefit from informational advantages.

Cons: Higher costs due to management fees and more frequent trading, which can reduce net returns. Greater risk of underperformance, as studies show that most active funds fail to beat their index over time. Requires extensive knowledge or professional advice to succeed.

Passive investing – pros and cons

Pros: Low costs, as there’s no active management to pay for. Broad diversification with just a few products – a single ETF can cover hundreds of global stocks. On average, passive investments deliver solid market returns and often outperform many active funds after costs. Simplicity and transparency, ideal for beginners.

Cons: No opportunity to beat the market – you settle for the “average”. In market downturns, the full extent of volatility is felt, as there’s no active intervention. Less room for personalisation or focus, as the fund strictly follows the index. Specialised opportunities may be missed.

Cost comparison: active vs passive

One key difference between active and passive investing is cost. Active funds charge management fees that are deducted annually from the invested assets, while passive products tend to have much lower fees.

A comparison in the Swiss market makes this clear: actively managed Swiss equity funds have an average Total Expense Ratio (TER) of around 1.5% per year, while ETFs tracking the Swiss Performance Index (SPI) cost on average just 0.13% per year. This difference of ~1.4 percentage points means active investors face a significant return deduction every year.

Over time, such cost differences can add up substantially. Experts refer to a “negative compounding effect”, as high ongoing fees reduce reinvested earnings. A simple example: with an investment of 50'000 CHF, 1.5% in fees equals 750 CHF annually, while 0.15% (a typical ETF) costs only 75 CHF. Over ten years, that adds up to a difference of around 6'750 CHF – money that could remain invested and generate further returns in a passive strategy.

In addition to fund fees, active trading may incur other costs, such as transaction fees for frequent buying and selling, or performance fees for certain funds. Passive investors typically follow a buy-and-hold approach and trade less often, keeping transaction costs minimal. Furthermore, index products tend to be more tax-efficient, as they make fewer adjustments, thereby reducing taxable events and realised gains.

Tip: Always check the total expense ratio (TER) and any additional fees when selecting products. Thanks to growing competition, Swiss investors now benefit from cost-effective options. For instance, digital banks and brokers like Alpian offer highly transparent pricing, making it easy to compare active and passive solutions.

Looking for expert investment advice? Schedule your free session with a wealth advisor today.

Case studies from Switzerland: successes and setbacks

Example 1: When active strategies fail

A recent study by VZ VermögensZentrum took a close look at Swiss equity funds and came to a sobering conclusion: the majority of actively managed equity funds fail to outperform their benchmark in the long run, despite high fees. Over 5, 10 and 15 years, more than half of the funds in this study underperformed the market. In other words, only around one in four funds manages to truly generate excess returns. For investors, identifying the few promising funds in advance is nearly impossible – yesterday’s winners are not necessarily tomorrow’s top performers. In the end, investors often end up with only market returns – and sometimes even less – despite the additional effort.

Example 2: When active investing adds value

But there are also success stories. Active strategies can be particularly effective in niche markets or specific themes. An analysis by the German fund association BVI for the year 2020 showed that some specialised equity funds significantly outperformed their indices – with excess returns of more than 5 percentage points in some cases. These winners often focused on future-oriented themes (e.g. technology, healthcare or sustainability) or niche markets. The reason: such areas are more prone to major price swings and inefficiencies that skilled fund managers can exploit.

Meanwhile, passive strategies have proven their worth for patient investors. Those who remained diversified and invested for the long term were generally rewarded with solid market returns. That’s why a tremendous amount of capital now flows into index funds and ETFs worldwide – their number nearly quadrupled between 2007 and 2015.

Conclusion: Which strategy is right for you?

There’s no one-size-fits-all answer to whether active or passive investing is “better” – it depends on your goals, knowledge, and risk tolerance. Here’s a summary:

Passive strategy: A good fit if you’re happy with market returns, want minimal effort and seek to reduce costs. A broadly diversified, passive portfolio can be especially sensible for long-term goals and retirement planning.

Active strategy: Interesting if you have strong views on the market or specific interests and want to try generating added value. If you enjoy engaging with your investments and spotting specific opportunities, active investing can deliver results – but be mindful of the higher risks and costs involved.

Many investors today choose a hybrid approach: for example, a core portfolio made up of passive ETFs (as a solid foundation), complemented by a few active investments in areas they believe in. This way, most of the portfolio remains cost-efficient, while still allowing room to make targeted decisions. It’s important to maintain diversification and regularly check whether your chosen strategy still aligns with your personal goals.

If you’re unsure, you don’t have to decide alone. Investment advice can help you find the right strategy or combination. Modern solutions like Alpian combine digital efficiency with a personal touch, supporting you in implementing your chosen strategy. Always remember that every investment involves risk: prices can fluctuate and past performance is no guarantee of future returns.

Let Alpian support your investment strategy as your digital bank with a personal touch.

)

)

)

)

)

)