Introduction

Welcome to the gateway into our investment philosophy. This guide is for anyone who is interested in investing - whether you’re a baby boomer or a millennial, wealthy or still working hard to get there. The only prerequisites for reading this guide are to be human and curious.

We’ve built the Alpian team around two principles:

- Democratising private banking

- Demystifying the world of investment

Our app takes care of the former, and this guide is one of our initiatives to help with the latter.

This guide focuses exclusively on the initial steps for every investor. They are the hardest but also the most important.

When you are ready to immerse yourself in our world of investment, turn the page!

Alpian TeamDisclaimer: The Content of this publication is for informational purposes only, you should not construe any such information as legal, tax, investment, financial, or other advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the laws of such jurisdiction.

Why Invest?

Lots of attention is given to investment topics like what to invest in and how to invest. But there is a more fundamental question that deserves our focus: Why invest? What are the benefits, and is it a good use of your money?

We must begin with an important fact: the human brain is not programmed to invest. It’s great at spending, saving and donating, but investing goes against our nature.

It’s because we - humans - struggle with two things: risk and delayed gratification. We don’t like to sacrifice immediate enjoyment for potential rewards in the future:

- We know an MBA leads to exceptional earning, yet the long years of study put most of us off

- We know becoming an athlete requires disciplined training, and most of us choose not to become athletes.

The same goes for investing.

But let’s examine some of the benefits of putting your capital to work through investments.

Reason 1: It’s a complementary way to achieve your goals

Let’s look at these very real human desires:

- Is it hard to imagine that you’ll have a child who wants to go to university?

- Do you want to enjoy your later years without fearing for money?

- Would you like to pay for a family meal at a restaurant without thinking twice about the bill?

With those in mind, let’s look at your options for achieving these.

You can increase your salary

You can win the lottery

You can invest

Increasing your salary

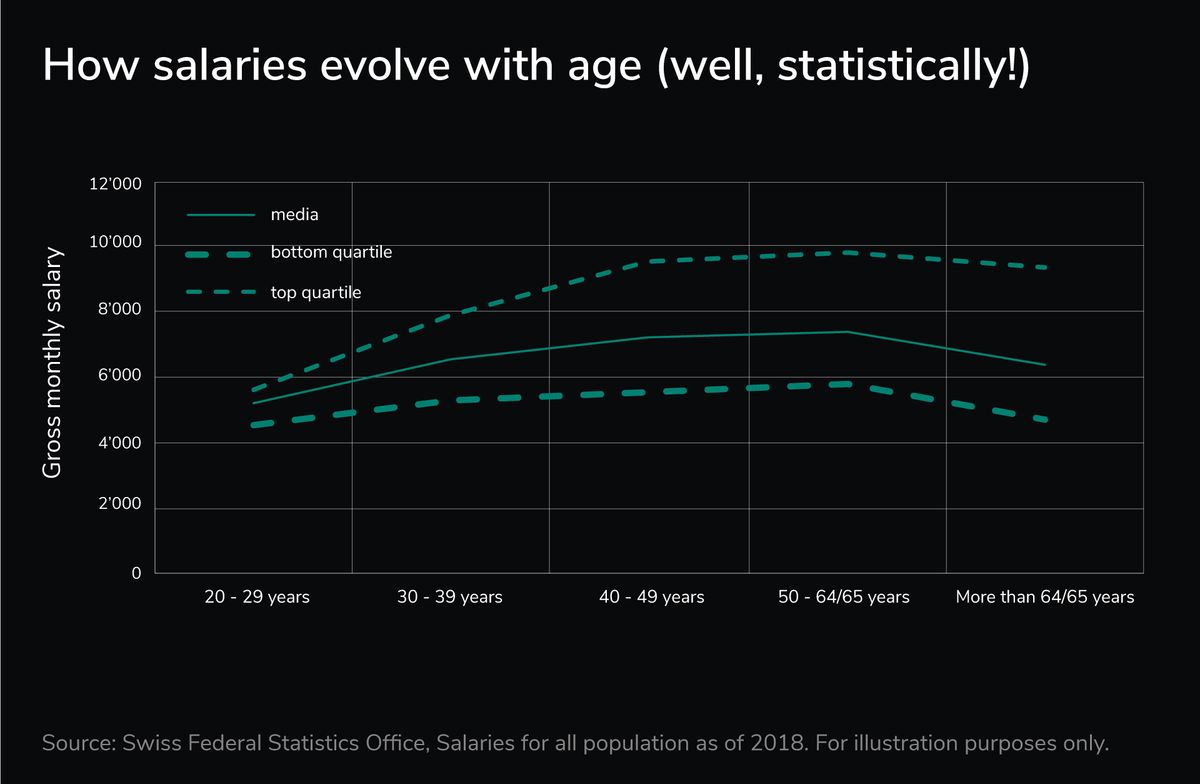

We can strive to improve our salaries, but there are limits. Statistics show that they tend to rise quickly in our early years, before slowing in growth. It’s during later years of employment that salaries slow down the most - so there’s a chance it might not be enough to make all of your dreams come true.

Winning the lottery

When it comes to the lottery, the amount you can win is exciting... but the odds aren’t in your favor: 20 years of Swiss lottery data show us that for the tens of thousands of tickets sold, there are only on average 24 new millionaires made per year1. At least one silver lining is that the Swiss government usually commits all this revenue to public utility projects!

Investing

Well-diversified investment portfolios usually grow in value over time. Compound interest has a dramatic impact when it’s given decades to work its magic.

Investing can be done in conjunction with working on your salary – especially thanks to the fact that as your salary becomes more likely to stagnate (in later years) compound interest is likely to yield more returns.

Reason 2: Meet the three financial plagues

Inflation, taxes, and fees are all working against your financial future.

While taxes and fees are straightforward, it’s worth our time to break down inflation in more detail.

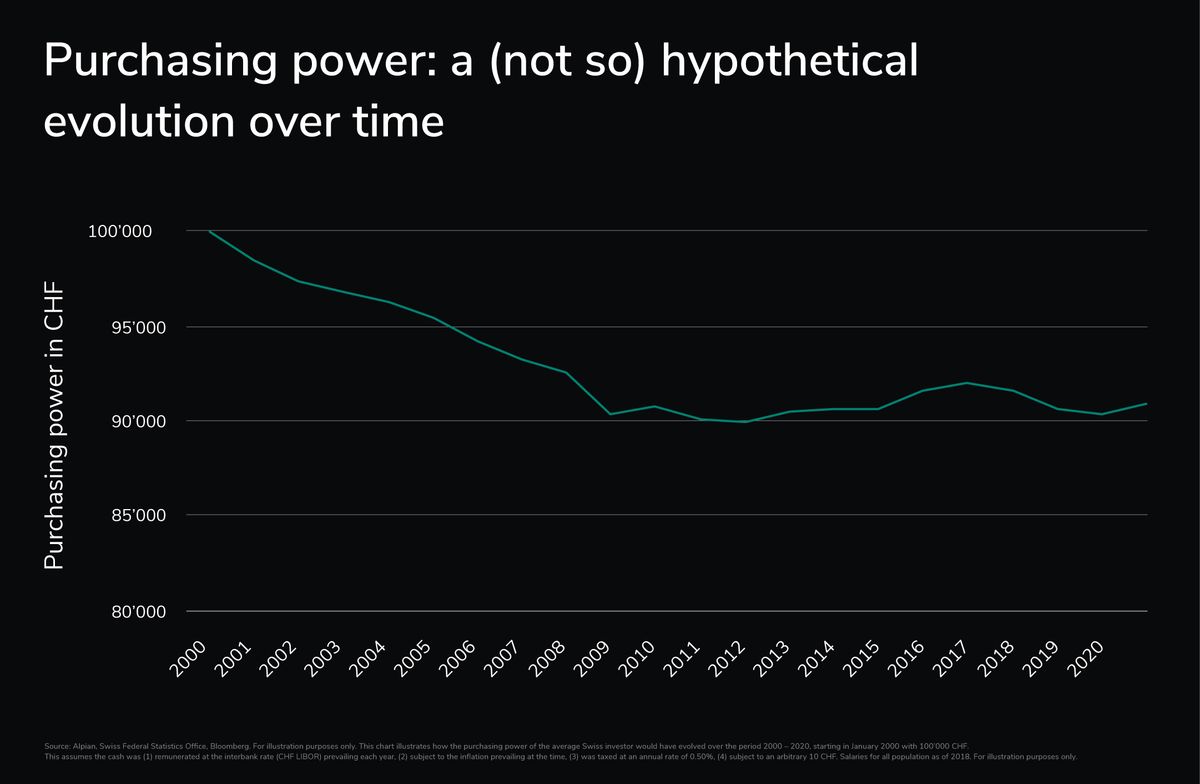

Inflation describes the fact that the prices of all the goods and services we buy - from food to clothes to housing - tend to rise over time. For example, the average rent in Switzerland has gone up by 66% over the past 30 years.

What makes inflation complex is that it’s influenced by so many factors - high demand, supply shortages, and central bank interventions are but a few of them.

This means inflation can change unpredictably - like in the early 90s when Switzerland saw dramatic prices rise2!

We are somewhat protected from inflation when our incomes rise at a similar rate. But first of all, that doesn’t always happen... and second of all, the same protection isn’t offered to any cash sitting in our accounts as savings.

When you consider the fact that that same cash could be invested and earning more over time, it’s concerning to know that it’s losing value every year thanks to inflation.

Reason 3: You’re already investing

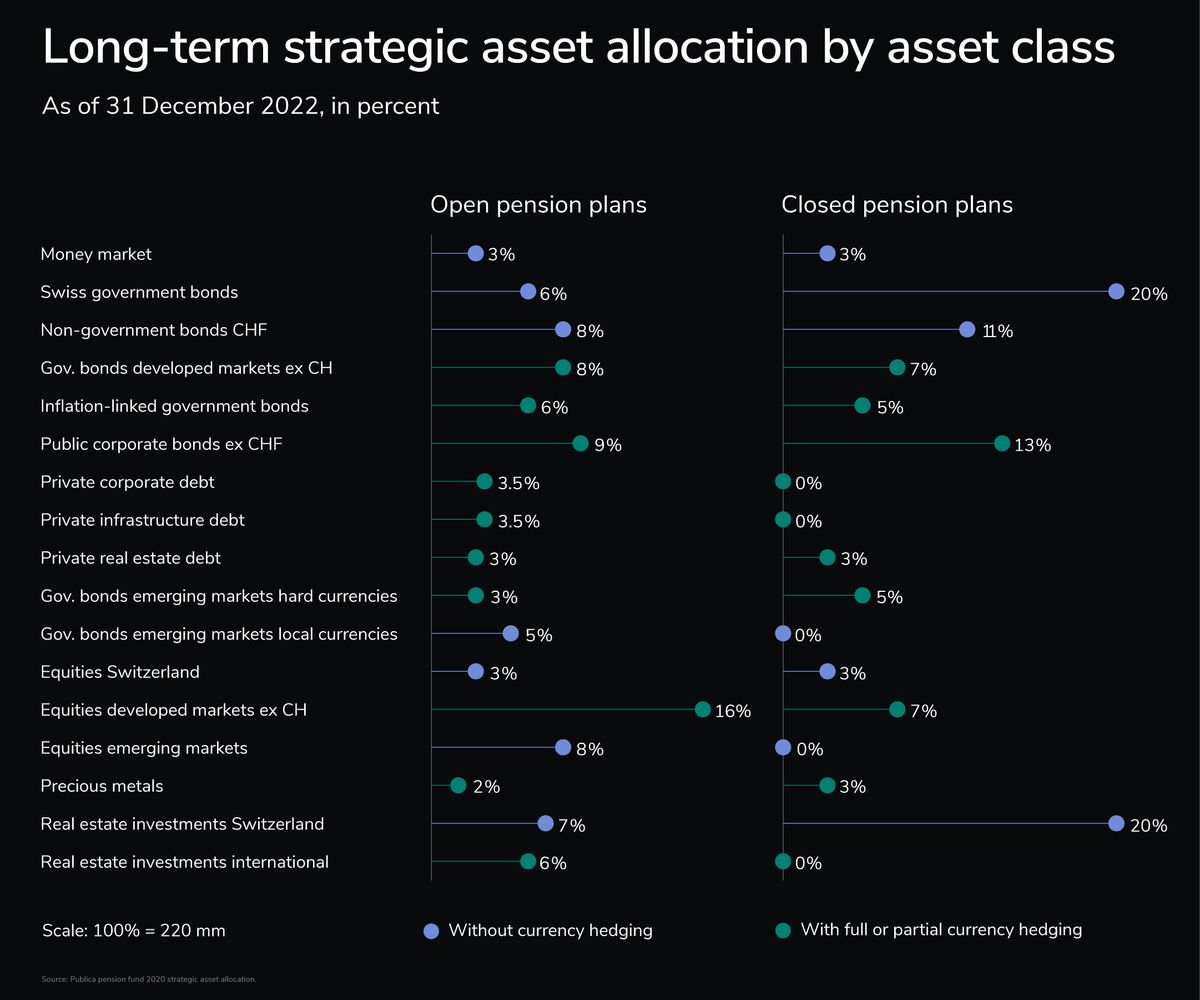

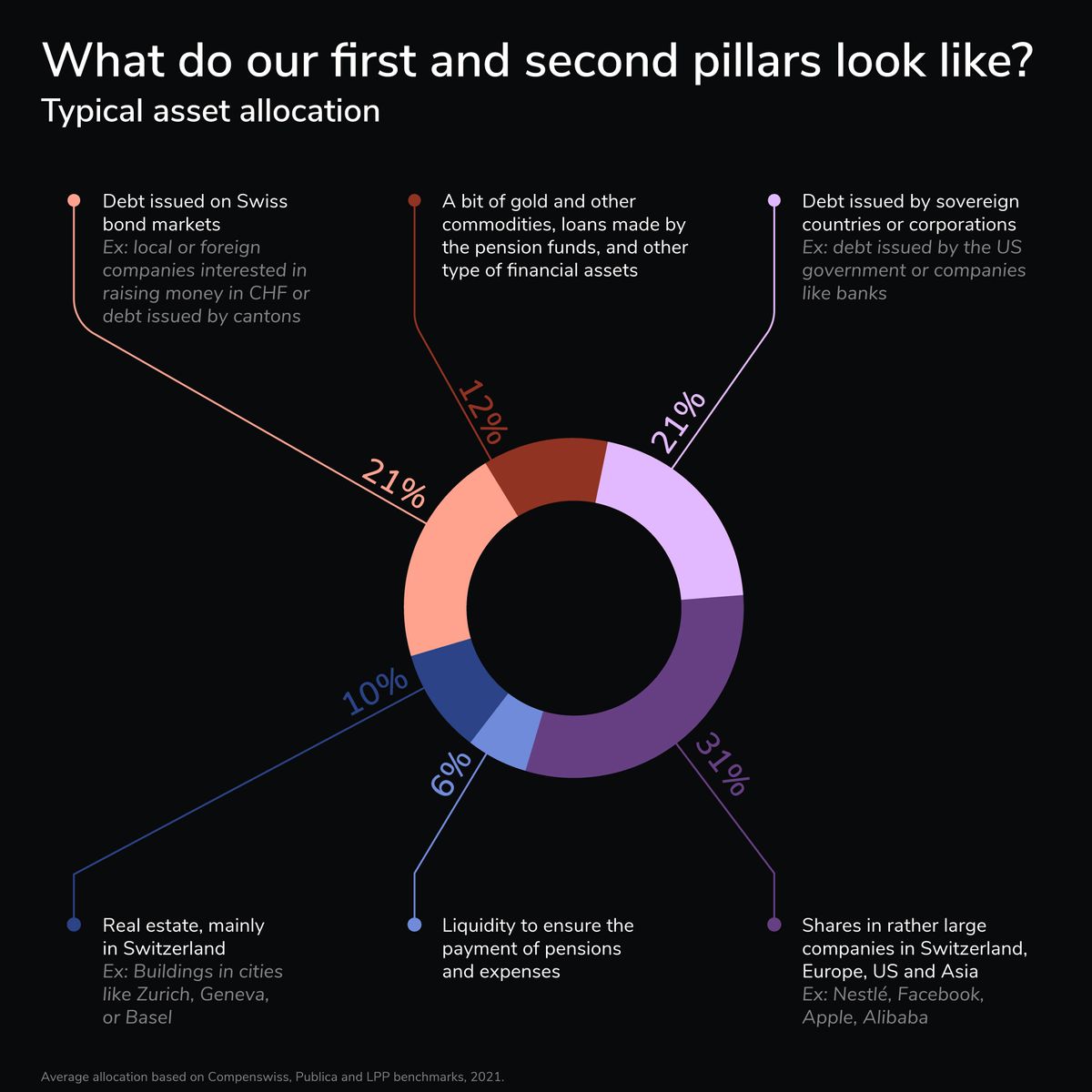

You might still have reservations about investing. But that doesn’t mean your money isn’t being invested. First, there’s your pension. On average, in Switzerland, 153% of our monthly earnings goes into our 1st and 2nd pillar. Our pension funds invest this money into a variety of assets - from equities to bonds to real estate – and use the returns to fund our retirement.

The money sitting on your savings account is also being invested. While you’re not actively using it, the bank is lending it to businesses and people, and charging them interest.

It’s important to remember that these investments aren’t without risk. So it’s false to see a savings account as totally risk-free – even when the government is prepared to catch the pieces in times of crisis. While this may sound shocking, the point is to draw your attention to the fact that your money is being invested whether you like it or not.

Taking the leap and consciously investing it is only a small step away.

1Source: Swiss loto, millionnaires statistics, 1979-2022

2Source: Office Fédéral de la Statistique 1990-2020

3Source: Federal Statistical Office , Household budget 2021

Disclaimer: The Content of this publication is for informational purposes only, you should not construe any such information as legal, tax, investment, financial, or other advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the laws of such jurisdiction.

Chapter Summary

Let's summarise what we've discussed in this chapter. There are 3 reasons why you could consider investing:

- It is a complementary way to help you reach your big financial goals

- Money sitting as cash in accounts is typically losing value, rather than gaining it

- Investing is a way to gain greater control over your finances

How Much?

Figuring out how much to invest is a matter of answering the question, how much money do I need?

That’s because committing your money to investments comes with a catch: if you find yourself needing to pull your money out early to pay for bills or unexpected events, there is a chance of that happening during a periodic downturn of the market. Not only will this cause you to lose money, you’ll also lose any chances of gaining a return over the long term.

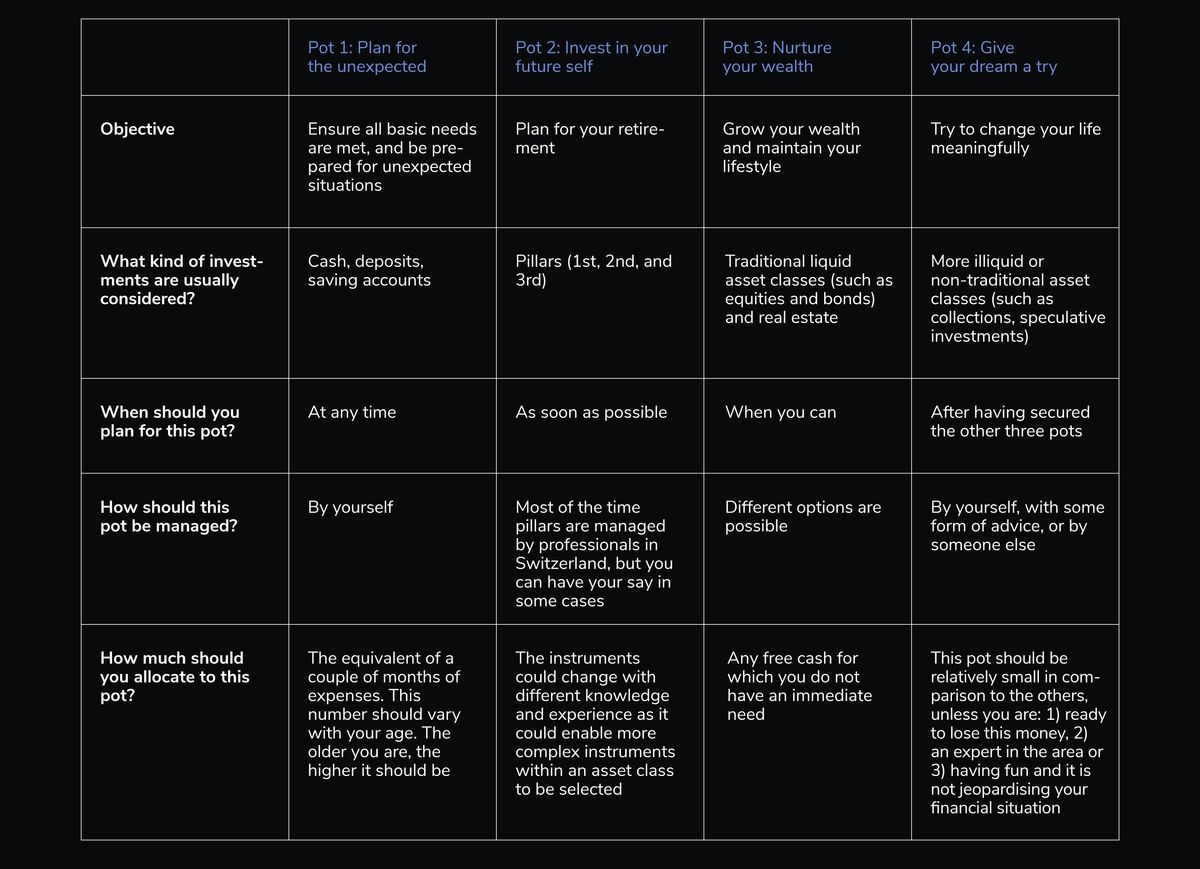

We avoid these scenarios by taking a crucial step before making any investments. We can visualize someone’s wealth by imagining it as four pots. The first pot is their iron reserve – a “safety net” of cash. The second is their pension. The third is their investments. And the fourth is for aspirational investments – opportunities that are of a higher risk but may lead to a dramatic change in life. Each pot has a different timeline and different purpose. In order to decide how much to put into our third (investment) pot, we must first understand how much is in the first two.

Plan for the unexpected

The first pot is what we call the “Emergency Pot” or “Cash Reserve”. We use this pot to make sure we have enough money to cover our regular expenses and daily lives, as well as a safety net for any unexpected expenses. Naturally, this pot should comprise of liquidity you can access (cash) or very liquid investments that can be easily turned into cash.

Many of us struggle to figure out how much to put aside for bad times. It’s because we react emotionally to the thought of losing our jobs or facing difficult times, and then overestimate or underestimate the amount needed. Some rules of thumb can be found on the Internet – for example, some professionals suggest putting aside 24 months of expenses.

Sizing your emergency fund by estimating monthly expenses is a good idea – it reflects the commitments you will still face in the case that you lose your income – but we would suggest an important addition. This number should vary with your age. Bouncing back will be easier when you are young, relative to when you have a dependent family, or are reliant on a pension.

Invest in your future self

The money in your second pot includes your pension assets and, if you are working, your second pillar. Your pension fund is an investment managed by others – which shows that the leap to making your own conscious investments is closer than you’d think! If you want to see how your second pillar is working and how it’s invested, we give you an overview in the chart below.

One key message here is that we tend to overlook our pensions. Why? Because they’re perceived as boring or relating to a time far away in the future. But we have some advice here:

- The earlier you can plan your retirement, the better. Swiss pillars operate on subtle mechanisms and change over time. Lately, weak interest rates have painted a morose outlook for the younger generations, and this is why it’s important to understand what awaits you in the future. You’ll find key information in the pension benefit summary you receive at the end of each year, and it’s a great idea to speak with your company’s employee representatives who sit at the board of the pension fund. If you’re self-employed, you can find interlocutors too.

- The 2nd pillar has its own unique potential to be rewarding and it can make sense for some people to voluntarily contribute to it. Financial planners and tax specialists can help you to navigate this for yourself.

- Pension funds teach us a fundamental investment lesson: Every month, a portion of our salary goes into the pillars without us necessarily being conscious of it, and years later - when it is time for retirement - we discover that this capital has worked hard on our behalf.

Nurture your wealth

After calculating a cash reserve and making sure your retirement plans are in good shape, you can consider committing the remaining money to investments (your third pot). This is logical because

- You shouldn’t need to access this remaining cash for a long time and

- You’re unlikely to get large returns by leaving it in a savings account (In Switzerland, you can consider yourself lucky if you have a savings account paying an annual interest rate higher than 0.15%!). As we saw in chapter 1, inflation’s impact on cash means there’s little reason to leave cash in an account unless you plan to make use of it in the near future.

Give your dream a try

Finally, there’s the fourth pot. This pot is optional and, in our view, it should only be considered after you’ve built the first three pots. We find it exciting to allocate a small amount for riskier (and sometimes exotic) investments that we are passionate about. You can think of these opportunities as things like speculating, buying digital assets, and even collecting items like art, wine, and books. Even if the odds are low, one of these investments may really pay off and take you to the next level. But our advice is to treat the money in this pot a bit like a lottery ticket: be ready to lose it and don’t put in more than you can afford.

To recap, the key question for you to answer before starting investing is how much you should put in each pot. You can use the acronym, PING, to remember this:

Disclaimer: The Content of this publication is for informational purposes only, you should not construe any such information as legal, tax, investment, financial, or other advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the laws of such jurisdiction.

In What?

Everybody has countless investment opportunities available. This chapter isn’t designed to tell you which ones to invest in, but to give you an overview of the different types that exist. Now, if you’re an economist, please forgive us. But for simplicity’s sake, we can group all assets into four different types:

- People

- Things

- Organisations

- All means of exchange between the three previous categories

Imagine all the people

People may not be the first thing that comes to mind when you think about investment, but they truly are an investment category. You can use yourself as an example: you are a machine that produces income, and that can be considered an asset for the society. Yes, that may sound shocking at first – nobody wants to be seen as a resource – but this is an economic reality. You invested in some form of training that allowed you to get a job and generate revenue.

It is also worth investing in people around us. We do this indirectly through taxes and our pension funds, but we can also do it more directly, like by financing our children’s studies for example. It’s important to remember that at some point they will be the ones financing our pensions!

The (not so) bare necessities

This is probably the category we are the most familiar with because it is also the most tangible. We are all used to buying and consuming things: physical goods, houses, food, etc. But if you look at these through a different lens, they can be investment opportunities too.

Let’s take a tour:

Commodities: Pretty much anything that surrounds us was once a raw resource or material. The wheat in our pasta, the coffee in our cup, the metals in our phone, the fuel in our car, the gold in our ring, etc. These commonly used resources are commodities, and they are traded all around the world in markets that bring together producers, traders, manufacturers and consumers. These assets can be part of investor’s portfolio (though as contracts, rather than in their physical form!).

Property: Real estate is dear to many people in Switzerland and abroad. But if we put aside real estate’s main purpose – providing us with a roof - real estate is also a popular investment type that can complement investors’ portfolios and generate regular income. Real estate is relatively capital extensive (you need a large sum of money to buy a property) but new forms of participative financing are emerging to make home ownership easier.

Collectibles: It’s incredible how many things can become collectibles: wine, coins, stamps, artworks, books, video games, posters, figurines, vinyl records, cards, furniture, jewels, and memorabilia are just a few! And many investors understand that collections have a valuable and enjoyable place in portfolios. While they have very specific financial behavior and can be quite illiquid (selling them at a fair price may take time), they offer certain advantages in terms of diversification.

In search of good company

Let’s turn to the third category: organisations. By organisation, we mean entities comprising one or more people that are grouped around particular purposes.

While there are many types of organisations, we’re concerned with two of them: governments and businesses.

Both need financing - countries, cantons, and cities need it for social projects and to pay administrative staff. Businesses need it to finance their growth.

For public institutions, the main form of financing is debt. For example, the canton of Geneva recently issued a green bond to finance the development of the CEVA - an orbital rail line that connects several stations in the city. How does it work?

Basically, public institutions look for investors to lend them money for a certain period and promise to pay it back with interest (the same principle as your mortgage if you have one). Companies do this too. There are many possible forms of debt: loans (often granted by banks and financial institutions), bonds, and notes. And as an investor, you can buy those (i.e. lend your money).

In practice, the most popular form of debt for investors is bonds (both government and corporate bonds). One of the main advantages for people who invest in bonds is that they provide a certain form of visibility (you know the interest you’re likely to get from the borrower over the period of the loan). In addition, they can be less risky than other investment types (for example, if you lend your money to the Swiss government, chances are high that you will get it back). However, the high visibility of your return and the lower level of risk is reflected in lower potential returns than other investment types.

For companies, there is another main way to raise money in addition to debt: by issuing equity. Small companies find it difficult to obtain loans from banks or issue bonds because they are seen as a higher risk to institutions. So issuing equities is often the preferred way for startups and small companies to finance their activities. What are equities? In essence, an investor will put some capital into the business and in return will claim a portion of its income and assets. For example, if the investor owns one share in a company that has issued 10 shares, he is entitled to a tenth of the company income and a tenth of the assets. In essence, owning stock means owning a portion of the company. The advantage is that if the company grows, the investor is likely to benefit a lot. But the inverse is also true: the investor shares in the risks and may lose money if the company performs poorly or goes bankrupt.

So, to summarise (and to simplify as well), you can invest in organisations in two ways: by buying bonds (debt) or equities.

Glue me if you can

Linking people, things, and organisations requires mediums of exchange. These include anything that can be used as a form of currency, from FIAT money to commodity money, to representative money, to cryptocurrencies.

You are probably already familiar with currencies. If you have travelled to a foreign country, you may have exchanged your Swiss Francs against that country’s currency.

But traveling is not the only reason why investors buy currencies. In fact, you can consider currencies to be investments too. Their values are often linked to aspects of countries’ economies, and you can bet on their appreciation or depreciation. For example, Switzerland has a strong economy with little debt, which has led the value of the Swiss Franc to go up on average against other currencies over the past decade.

And if you don’t believe in any countries or if you are looking for other currencies besides FIAT currencies (those issued by governments), you can consider the newcomers in the area: Cryptocurrencies.

We’ll close this chapter with a couple of remarks. As we’ve seen, the investment world is a vast one. While you can group investment into four broad categories (and that’s not an exhaustive list), there are a myriad of different subcategories inside each one. Over time, you’ll learn to focus on the ones that are best suitable for your given situation. But if we can give you one piece of advice: always invest into something you understand.

Disclaimer: The Content of this publication is for informational purposes only, you should not construe any such information as legal, tax, investment, financial, or other advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the laws of such jurisdiction.

With Whom?

It’s time to answer a big question: How do I get started with investing?

Easy peasy... Really?

Getting started is as simple as opening an account with a bank, a broker, or a fintech, putting in some money, and buying anything you want. In fact, you’re probably in one of the best countries in the world for that! Indeed, with 2464 banks, 2’552 branches, and a wave of dedicated investment apps coming to the markets, Switzerland is a country with one of the most prominent banking sectors.

But is this the answer you wanted to hear? Perhaps you should pause for a second and take some time to think.

When the most important part of investing is making informed decisions, simplicity may not be the best thing in the world. With that said, there’s an underlying question here to ask yourself: Do you have what it takes to invest? We’re not talking about courage here, but instead the practical considerations: time, will, and experience.

To understand why these are important, let’s briefly examine how many opportunities are in front of you.

While it’s hard to come to a precise number, Switzerland’s top brokerage houses can give you access to between 40,000 and 3,000,000 securities (assets that you can trade on financial markets). Not bad, isn't it?

The right investments for you lie somewhere within those thousands of opportunities, and it’s up to you to find them. Easier said than done.

Indeed, picking through that universe could be tedious - especially if you don’t know exactly what to look for. But don’t be discouraged. Our point here is to illustrate that investing requires some personal time and energy. And if you don’t have that, you’ll probably need support.

What is your flavor?

Depending on your state of readiness, and the support you might need, there are three main options available to you.

- Do it yourself. All you have to do is to open a trading account. If you possess the soul of an adventurer, this place is for you. For a fee, you can buy and sell anything that is available to you on trading platforms. This is the option that offers you the most freedom – with the caveat that you are on your own. It’s your responsibility to pick the right investments.

- Guided investing. You invest with advice from a human or purpose-built system. Many banks, brokers, and online apps provide this type of service and it’s a great way to simultaneously learn and get started.

- Concierge investing. When you’re not ready to devote your time and energy to reviewing and selecting investment opportunities, but you acknowledge the importance of investing, this is for you. Management of your investments will be totally delegated to a financial professional. It’s important to know that this means being comfortable with giving up control!

Before jumping to a conclusion and hastily selecting one of these three solutions, we’d like to give you a precious piece of advice: as an investor, your needs and what you are curious about will evolve over time, as will the financial markets. Therefore, the chances are high that you will switch from one solution to another, or use a combination of them.

Whichever path you choose, it’s important that you do two things:

- Stay in the know at all times – understand your investments’ performance.

- “Tune up” your investment from time to time. We’ll explain why in a moment.

Informed. Nothing more, nothing less

Nearly all children experience the fascinating process of planting a seed and watching it turn into a plant.

Initially, there’s curiosity. Then, there’s impatience. And finally, there’s excitement.

While some of us continue to marvel at this phenomenon as adults and cultivate our own vegetable gardens, few of us truly grow our own food. We rely on farmers and go to supermarkets to buy the vegetables, fruits, and meat that satisfies our stomachs. And sometimes, this blind trust leaves us with bitter aftertastes - from the small inconvenience when our local supermarket is out of strawberries on the day we planned to make our favorite panna cotta recipe, to the food industry scandals that make us feel vulnerable. With that said, we rarely consider the alternative – foregoing supermarkets and embracing food self-sufficiency. And that’s for a good reason - growing your own food is a full-time job.

The same goes for investing.

To manage your investments yourself, you need knowledge and nerves. Yes, if you choose that option, you’ll be 100% in control of your decisions and financial fate, but that freedom comes with responsibilities and hassles. Here are some points to consider:

- Doing it yourself is not necessarily cheaper. First, professionals have more bargaining power when it comes to negotiating fees. Second, if you add all the small costs (trading fees, custody fees, minimum amounts, thresholds, placement fees, etc.) you may not be better off.

- Doing it yourself does not necessarily work. Recent studies have shown that most individual investors lose money, and we believe this is due to inexperienced traders basing many of their decisions on what grabs their attention rather than on clear investment criteria5.

- Doing it yourself means that you must confront your own behavioral biases, which can cost you a lot. Non-professionals (called “retail investors”) tend to have more concentrated portfolios and struggle with decisions such as “how much to put in each investment” or “when to buy and sell”.

- Doing it yourself means that you must be able to separate information from noise. It’s easy to access financial information, but how good is its quality? Remember that brokers make it easy for you to trade because the more you buy and sell, the more they collect fees.

- Doing it yourself means that you need to be equipped. Do you have enough time to devote to your investment? Do you have the right tools to monitor your portfolio, follow its performance, assess risk, and understand the overlap between different investments?

In short, self-managing your investment can bring clear advantages like more control and the assurance that your portfolio resembles you. But should you lose money, you will be the one to blame. When you delegate the management of your wealth, it’s a different story.

You give the keys to a professional, which allows you to focus on other important aspects of your life and holds someone else accountable for the eventuality that your portfolio underperforms. But of course, the delegation has its drawbacks, too:

- Delegating means accepting that you don’t control every investment decision. Usually, working with a professional means devising a plan together (your investment objectives, level of risk, preferences, constraints, etc.) but leaving investment decisions to the professional. You will not always be able to question his choices.

- Delegating is an act of trust. You trust that every decision will be in your best interest and not your advisor’s.

- Delegating means accepting some form of standardisation. Managers usually manage money for dozens or thousands of clients. By “pooling” clients’ money, they can achieve substantial economies of scale (better fees, better controls, etc.) which comes at the cost of customisation.

So, each solution has its pros and cons. The good news is that you are best placed to know which one will be best for your individual situation. Maybe supermarkets have advantages for your day-to-day but you enjoy growing some vegetables yourself, too.

4Source Banque Nationale Suisse, EBF, as of 2020

5Attention Induced Trading and Returns: Evidence from Robinhood Users by Brad M. Barber, Xing Huang, Terrance Odean, Christopher Schwarz :: SSRN

Disclaimer: The Content of this publication is for informational purposes only, you should not construe any such information as legal, tax, investment, financial, or other advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the laws of such jurisdiction.

When And For How Long?

Whether you decide to invest alone or with the help of a professional, there are two questions for you to consider: “When to invest” and “for how long”.

Let’s be clear - these are some of the most difficult questions to answer in finance. The first the is linked to what we call "market timing" and the second Is linked to what we call your investment horizon. Let us explain.

Are we there yet?

On paper answering "when should I invest?" is quite simple. First, you should Invest when you feel ready, and second, you should invest when the market conditions are favorable. "Favorable market conditions" describe an economic environment that is friendly and in which investment opportunities are likely to deliver financial returns. After reading chapter 2, you should have better visibility over the portion of your wealth that you can Invest without jeopardizing your financial situation. You’ve done your math and thus feel more prepared to act. But preparedness does not mean readiness. And we would be surprised If some emotions do not overwhelm you just before you push the "Invest" button.

It’s normal to experience thoughts like, "is It really the right time to Invest?", "a lot of bad things are happening in the world right now and I have heard it could get worse...".

Our emotions are powerful allies that help us do good things like make ethical investment decisions. But they can also get in our way. Take fear: It originates from a small part of our brain called the amygdala. It’s a powerful mechanism that can help us act in dangerous situations. But it also greatly affects our capacity to think and sometimes prompts us to take the wrong financial decisions, like selling our investments too quickly or overestimating risks that affect us. Suppressing emotions is impossible – they're embedded in our brains - but we can manage them. Here are a couple of techniques worth trying:

- Regularly reviewing your investment strategy to make sure you stick to it

- Embed safeguards in your investment process (for example, you can invest gradually)

- Accept that investing necessarily Involve risks

Ultimately, building a successful investing process is as much a matter of knowledge as it is a matter of self-control. And the good news is that with a little focus and patience, we can cultivate both. This leaves us with the other question: “Is it a good time to Invest In market right now?”

Here’s the truth: Answering that question is impossible without clairvoyant abilities.

In finance, there are two inevitabilities:

- You only learn when it was the right time to buy or sell an asset afterwards.

- In the moment, you are presented with investment opportunities that seem more or less risky. And often, their price reflects the amount of risk. But it is perceived risk. When you are in a middle of a financial crisis, everything looks risky and prices tend to decrease, but if the crisis resolves itself and you bought assets at a bargain, then the chances are high that you will make some money. On the contrary, when the outlook looks rosy and all assets are up, this this probably when real risks are being underestimated. So apparent risks and real risks are two different things, but back to the previous inevitability - you only figure this out afterwards.

If you believe in your ability to time the markets or if you believe that some people can call when it is the right time to buy or sell an asset, consider the following case: Mark Hulbert, a financial professional, spent the last four decades tracking the performance of investment newsletters. Most financial companies pay experts, analysts, financial gurus and pundits to produce newsletters in which they disseminate their investment advice. In short: what to buy and when.

So, if anyone can prove it’s possible to time the markets, it’s surely someone in this space. Afterall, who is better placed to do it than financial professionals? And if it is possible, it must translate into excellent performance (if you buy something when its price is low and sell it when it is high, you must make money!).

Many experts brag about their ability to read financial markets but Mark Hulbert’s study paints a very different picture6. If a few experts are able to outperform the markets sometimes, they don’t do it consistently... and the vast majority don’t do it at all. It’s reasonable, then, to believe that if financial professionals fail to do it, timing the markets must be very complicated. In fact, when you look at the most successful investors like Warren Buffet, Ray Dalio or Jim Rogers who deliver outstanding returns over long periods of time, they attribute their success to other skills than timing the markets: they ability to find good investment opportunities and stick to them.

To sum it up: those who claim that they can time the markets are rarely doing so and those who deliver exceptional returns say that timing the markets is a foolish game. So, unless you possess clairvoyant abilities, you should acknowledge that “is it a good time to invest?” is a difficult question.

More importantly, the excessive amount of time we spend on that question distracts us from another truth: the time you spend in the markets matters even more! We often delay investment decisions, but if we look back at history, over long period of time, markets have tended to reward patient investors who didn’t put all their egg in the same basket. And the opportunity cost of waiting is missing the best periods.

So, to conclude, “when to invest?” is ostensibly a key question, but paradoxically one that you shouldn’t spend too much time on. And for four reasons:

- Timing the market is practically impossible

- Emotions will always get in your way, even if facts convince you that it is the right time

- Your time could be devoted to other, equally important questions

- You are likely to learn by doing, and making mistakes is part of the process of becoming a better investor.

How long is long term?

Let's assume that you’ve found the necessary resources (both financial and psychological) to invest. Now, there’s a last question that needs to be addressed: “for how long?”

In the finance world, we refer to the length of time you intend to invest as your time horizon. And what determines your personal time horizon is your unique financial goals and constraints.

Whether that’s funding your child’s education, your retirement, or a house, it’s these big life plans that indicate how long you have to invest. Keeping that in mind, it’s a good rule of thumb to remember that the longer you can stay invested, the better. There’s logic behind it.

Very few companies grow exponentially in a short period of time (and those that do can decline just as quickly). At the same time, many companies grow exponentially over a long period of time. That means we investors can increase our chances of returns by

- Diversifying our risk by spreading our wealth across a number of opportunities and

- Holding onto the assets we own for as long as possible.

Besides setting an exit date based on our big life plans, a few additional factors can be of influence.

Market events

When your intended exit date is close, any chances of a looming recession are worth considering. Market downturns are inevitable, but they’re no big deal when you have decades remaining in your time horizon. That’s because your assets are likely to recover from any loss in value over time. However, when you’re approaching your intended exit date, you don’t have room for your assets to recover over five to ten years. In such a case, it can make sense to adjust your intended exit date accordingly, or shift to assets with a lower risk-profile.

Changing life conditions

Change is the one constant we can guarantee in life. There’s a chance that down the track, you may have faith that a business idea of your own has a higher likelihood of delivering the returns you’d like. Or, you might find that you have a third child on the way. The point is that your financial goals may well change over the years, which will inspire you to change your investment arrangements.

6Stock Market Timing Study – From Mark Hulbert and Hulbert Financial Digest (hulbertratings.com)

Disclaimer: The Content of this publication is for informational purposes only, you should not construe any such information as legal, tax, investment, financial, or other advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the laws of such jurisdiction.

How?

If you’ve taken the time to think about the questions we’ve raised, you should now:

- Know the reasons behind why you’d like to invest

- Have established how much you can invest

- Have a slight idea of the different investment types the world can offer

- Have decided whether you are ready to invest alone or whether you need some form of support

- Be able to determine your time horizon for investments

What’s left?

A few major elements!

From here, it’s important you build a plan and continue learning about investment.

To make this as easy as possible, we’ve created a two-season email series that guides you through the process of building your investment strategy. It’s called The Masterclass, and you can send both seasons to your inbox here.

We’d also encourage you to browse through the articles, videos, and podcasts we’re regularly uploading to i-vest. These are all designed to imbibe you with the mindset of a long-term investor (and at the very least, should be entertaining!).

Welcome to the world investment. The adventure begins now.

About the authors:

Amandine Soudeille, Investment Analyst at Alpian

Amandine began her career in the Finance department of Porsche France in 2015 before working in the FX Sales desk of Société Générale CIB in Geneva and then as a Fixed Income Sales/Trader for Valcourt, a securities broker in Geneva. She holds a Master in Management (PGE) of Toulouse Business School, as well as a MSc in Finance of EBS Universität in Germany. Amandine has a passion for Porsche and loves playing golf, dancing Salsa or Argentine Tango.

Mattia Scolaro, Wealth Advisor at Alpian

Mattia is an experienced relationship manager who has more than a decade of industry experience. He spent 10 years at Credit Suisse working his way up from apprentice to Assistant Vice President at the company’s base in Geneva. He graduated in 2019 from the Kalaidos Banking + Finance School in Lausanne. He is a football fan, but also likes listening to music and travelling to discover new countries and cultures.

Victor Cianni, CIO at Alpian

Victor has more than 13 years of experience in wealth management. He has assisted many individuals, families, and institutions in their financial journey throughout his career, either by providing tailored advice on their investments or by managing assets on their behalf. He occupied a number of key positions within the investment divisions of CA Indosuez, Lombard Odier, and Citi Private Bank. He holds an Engineer’s degree in Bioinformatics and Modeling from the Institut National des Sciences Appliquées of Lyon, and he is a certified FRM. In his free time, Victor loves scientific readings and collecting rare books.

Disclaimer: The Content of this publication is for informational purposes only, you should not construe any such information as legal, tax, investment, financial, or other advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the laws of such jurisdiction.