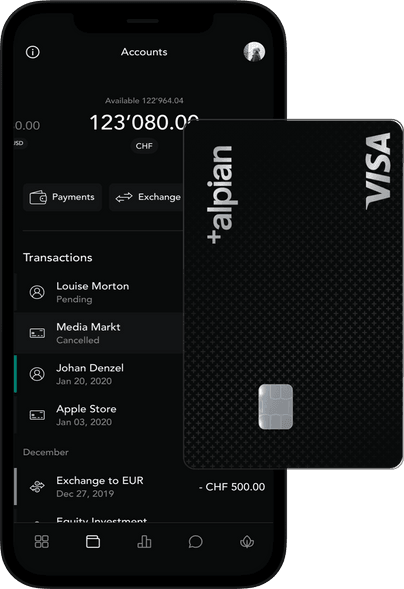

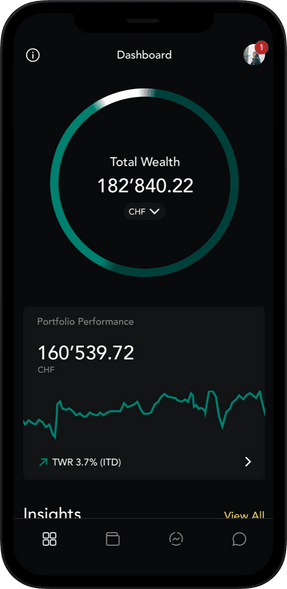

Experience the ultimate fusion of everyday and private banking - in just a few minutes.

Open an account now in just minutes and gain access to premium banking services and personalized investment portfolios.

Open an account

Open an account without a high minimum deposit.

Welcome to accessible premium banking. Download the Alpian app now and activate your account with an initial funding of just a few Swiss francs.

6 months no account handling fees

To help you start your premium banking journey with confidence and ease, we’ve waived all account handling fees for the first 6 months.

More returns with higher interest rates

For deposits between CHF 50'001 and CHF 1'000'000 we have increased interest rates from 1% to 1,5%.

Open your account in just a few minutes.

Download the free app now and enjoy the benefits of a secure, smarter, and more reliable premium bank.

1

Download the free app and open your account in just a few minutes

2

Activate your account with an initial transaction